Growth of the Automotive Industry

The overall growth of the automotive industry in Germany is a fundamental driver for the automotive glass market. As the automotive sector expands, the demand for high-quality glass products rises correspondingly. With Germany being one of the largest automotive markets in Europe, the production of vehicles is expected to increase, leading to a higher requirement for automotive glass. Recent estimates indicate that the automotive industry in Germany could witness a growth rate of 3% annually, which directly correlates with the demand for automotive glass. This growth presents opportunities for manufacturers to innovate and expand their product lines to meet the evolving needs of the automotive sector.

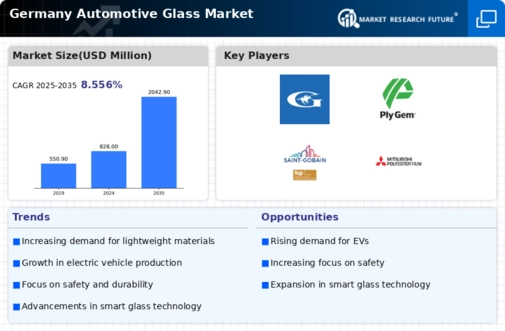

Rising Demand for Lightweight Materials

In the context of the automotive glass market, the increasing demand for lightweight materials is a crucial driver. As automakers strive to improve fuel efficiency and reduce emissions, the use of lighter glass solutions becomes essential. This shift is particularly evident in the production of electric vehicles, where every kilogram saved contributes to enhanced performance. The market for lightweight automotive glass is expected to expand by approximately 6% over the next five years, reflecting a growing preference for materials that do not compromise safety or durability. Consequently, manufacturers are focusing on developing innovative glass technologies that align with this trend.

Consumer Preferences for Aesthetic Appeal

Consumer preferences play a pivotal role in shaping the automotive glass market in Germany. There is a noticeable trend towards vehicles that not only offer functionality but also aesthetic appeal. This shift is prompting manufacturers to explore advanced glass designs that enhance the overall look of vehicles. Features such as tinted windows and panoramic sunroofs are becoming increasingly popular among consumers. Market data suggests that the demand for aesthetically pleasing automotive glass is likely to increase by 5% in the coming years, indicating that manufacturers must adapt to these evolving consumer expectations to remain competitive.

Regulatory Compliance and Safety Standards

The automotive glass market in Germany is significantly influenced by stringent regulatory compliance and safety standards. The German government mandates high safety requirements for vehicles, which include the use of advanced glass materials that enhance visibility and structural integrity. As a result, manufacturers are compelled to invest in high-quality glass solutions that meet these regulations. The market is projected to grow as the demand for safety features increases, with an estimated growth rate of 4.5% annually. This trend indicates that adherence to safety standards not only ensures consumer protection but also drives innovation within the automotive glass market.

Technological Integration in Automotive Glass

The integration of technology within the automotive glass market is emerging as a significant driver. Innovations such as heads-up displays and smart glass technologies are gaining traction, offering enhanced functionality and user experience. These advancements not only improve safety but also provide added convenience for drivers. The market for technologically advanced automotive glass is projected to grow by 7% annually, as consumers increasingly seek vehicles equipped with cutting-edge features. This trend suggests that manufacturers must prioritize research and development to incorporate these technologies into their product offerings, thereby enhancing their market position.