North America : Leading Market Innovators

North America is poised to maintain its leadership in the Geotechnical Engineering Services Market, holding a market size of $6.4 billion in 2025. Key growth drivers include robust infrastructure investments, increasing urbanization, and stringent regulatory frameworks that promote sustainable practices. The demand for advanced geotechnical solutions is further fueled by the need for risk mitigation in construction projects, particularly in seismic zones and areas prone to natural disasters.

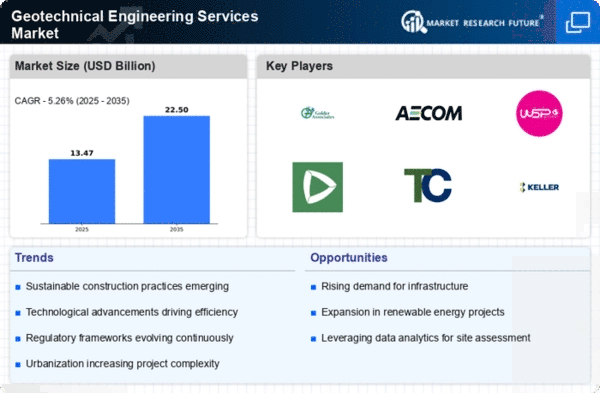

The competitive landscape is characterized by major players such as AECOM, Golder Associates, and WSP Global, who are leveraging innovative technologies and strategic partnerships to enhance service offerings. The U.S. and Canada are the leading countries, with a strong focus on research and development. The presence of established firms ensures a dynamic market environment, fostering continuous improvement and adaptation to emerging challenges.

Europe : Sustainable Development Focus

Europe's Geotechnical Engineering Services Market is projected to reach $3.8 billion by 2025, driven by stringent environmental regulations and a strong emphasis on sustainable development. The European Union's Green Deal and various national initiatives are catalyzing investments in infrastructure projects that require advanced geotechnical solutions. The demand for eco-friendly practices is reshaping the market, encouraging firms to adopt innovative technologies and methodologies.

Leading countries in this region include Germany, France, and the UK, where companies like Keller Group and Ramboll are prominent. The competitive landscape is marked by a mix of local and international players, all striving to meet the growing demand for sustainable engineering solutions. The focus on reducing carbon footprints and enhancing resilience against climate change is expected to further drive market growth in the coming years.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing a surge in the Geotechnical Engineering Services Market, projected to reach $2.8 billion by 2025. This growth is primarily driven by rapid urbanization, increasing infrastructure investments, and a growing awareness of geotechnical risks in construction. Countries like China and India are leading the charge, with significant government initiatives aimed at enhancing infrastructure resilience and safety standards.

The competitive landscape is evolving, with both local and international firms vying for market share. Key players such as Geosyntec Consultants and Terracon are expanding their operations in this region, capitalizing on the increasing demand for specialized geotechnical services. The focus on sustainable practices and innovative technologies is expected to shape the future of the market, making it a key area for investment and development.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the Geotechnical Engineering Services Market, with a projected size of $0.8 billion by 2025. The growth is driven by increasing infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries, where there is a strong push for urban development and mega-projects. Regulatory frameworks are evolving to support sustainable construction practices, which is expected to further stimulate market demand.

Leading countries in this region include the UAE and South Africa, where firms are beginning to recognize the importance of geotechnical engineering in project success. The competitive landscape is still developing, with local companies and international players like Mott MacDonald entering the market. As awareness of geotechnical risks grows, the demand for specialized services is anticipated to rise, presenting significant opportunities for growth.