Increased Focus on National Security

National security agencies are increasingly leveraging geospatial imagery analytics to enhance surveillance and reconnaissance capabilities. The Geospatial Imagery Analytics Market is experiencing growth as defense and intelligence organizations utilize advanced imaging technologies to monitor borders, track potential threats, and conduct strategic assessments. The integration of geospatial data with other intelligence sources allows for a more comprehensive understanding of security landscapes. As geopolitical tensions rise, the demand for sophisticated geospatial analytics solutions is likely to increase, emphasizing the critical role of this market in national defense strategies.

Integration of Advanced Technologies

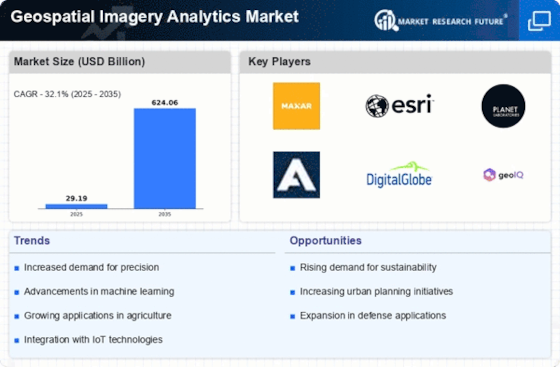

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the Geospatial Imagery Analytics Market. These technologies enhance the ability to process and analyze vast amounts of geospatial data, leading to more accurate insights and predictions. For instance, AI algorithms can identify patterns and anomalies in imagery that may not be visible to the human eye. This capability is particularly valuable in sectors like agriculture, where precision farming relies on timely and accurate data. The market for AI in geospatial analytics is projected to grow significantly, indicating a robust demand for these integrated solutions.

Growing Applications in Urban Planning

Urban planning is increasingly relying on geospatial imagery analytics to make informed decisions about land use, infrastructure development, and environmental management. The Geospatial Imagery Analytics Market is witnessing a surge in demand from city planners and local governments seeking to optimize urban spaces. By utilizing high-resolution satellite imagery and analytics, planners can assess urban sprawl, monitor traffic patterns, and evaluate the impact of new developments. This trend is supported by the increasing urbanization rates, with projections suggesting that nearly 68% of the world population will live in urban areas by 2050, further driving the need for effective urban planning solutions.

Enhanced Disaster Management Capabilities

The Geospatial Imagery Analytics Market plays a crucial role in disaster management and response. The ability to analyze geospatial data in real-time allows for better preparedness and response strategies during natural disasters such as floods, earthquakes, and wildfires. Governments and organizations are increasingly adopting geospatial analytics to assess damage, plan evacuations, and allocate resources efficiently. The market for disaster management solutions is expected to expand, as the frequency and intensity of natural disasters continue to rise. This trend underscores the importance of integrating geospatial imagery analytics into emergency response frameworks.

Rising Demand for Environmental Monitoring

Environmental monitoring is becoming a priority for governments and organizations worldwide, driving growth in the Geospatial Imagery Analytics Market. The need to track changes in land use, deforestation, and climate change impacts has led to increased investment in geospatial technologies. Satellite imagery and analytics provide critical data for assessing environmental health and compliance with regulations. The market for environmental monitoring solutions is projected to grow, as stakeholders seek to address sustainability challenges and promote responsible resource management. This trend highlights the essential role of geospatial imagery analytics in fostering environmental stewardship.