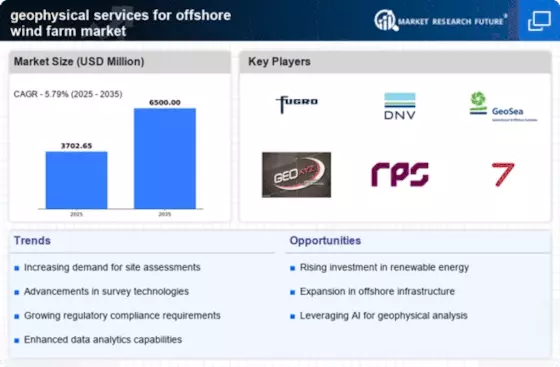

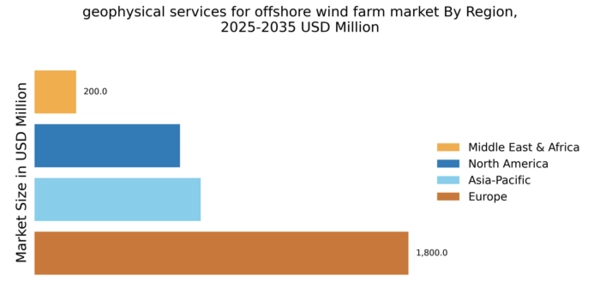

North America : Growing Renewable Energy Sector

The North American market for geophysical services in offshore wind farms is projected to reach $700.0M by December 2025. Key growth drivers include increasing investments in renewable energy and supportive government policies aimed at reducing carbon emissions. The region is witnessing a surge in demand for offshore wind projects, driven by the need for sustainable energy solutions and job creation in the green sector. Leading countries such as the U.S. and Canada are at the forefront of this growth, with significant investments from key players like Tetra Tech and WSP Global. The competitive landscape is characterized by a mix of established firms and emerging players, all vying for a share of the expanding market. The focus on technological advancements and environmental assessments is crucial for project success, ensuring compliance with regulatory standards.

Europe : Market Leader in Offshore Wind

Europe continues to lead the offshore wind farm market, with a projected market size of $1,800.0M by December 2025. The region benefits from robust regulatory frameworks and ambitious renewable energy targets set by the European Union. These factors are driving demand for geophysical services, as countries aim to enhance their offshore wind capabilities and meet sustainability goals. Countries like Germany, the UK, and Denmark are spearheading this growth, supported by key players such as Fugro and DNV. The competitive landscape is marked by innovation and collaboration among industry leaders, ensuring the deployment of cutting-edge technologies. The European market's focus on environmental sustainability and energy security positions it as a global leader in offshore wind development.

Asia-Pacific : Emerging Market for Wind Energy

The Asia-Pacific region is witnessing significant growth in the offshore wind farm market, with a projected size of $800.0M by December 2025. Key drivers include increasing energy demands, government incentives for renewable energy, and advancements in technology. Countries are focusing on diversifying their energy portfolios, leading to a surge in offshore wind projects and the need for geophysical services to support these initiatives. Leading countries such as China and Japan are making substantial investments in offshore wind infrastructure. The competitive landscape features both local and international players, including GEOxyz and RPS Group, who are actively participating in project development. The region's commitment to renewable energy is expected to drive further growth and innovation in the offshore wind sector.

Middle East and Africa : Emerging Renewable Energy Frontier

The Middle East and Africa region is gradually emerging in the offshore wind farm market, with a projected size of $200.0M by December 2025. The growth is driven by increasing awareness of renewable energy benefits and government initiatives aimed at diversifying energy sources. Countries are beginning to explore offshore wind as a viable option to meet their energy needs and reduce reliance on fossil fuels. Leading countries such as South Africa and Morocco are taking initial steps towards developing offshore wind projects. The competitive landscape is still in its infancy, with opportunities for both local and international players to establish a foothold. As the region continues to invest in renewable energy, the offshore wind market is expected to gain momentum, attracting more stakeholders and investments.