Generic Drugs Market Summary

As per Market Research Future analysis, the Generic Drugs Market Size was estimated at 437.9 USD Billion in 2024. The Generic Drugs industry is projected to grow from 478.89 USD Billion in 2025 to 1171.71 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 9.36% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Generic Drugs Market is experiencing robust growth driven by increasing demand for affordable medications and technological advancements.

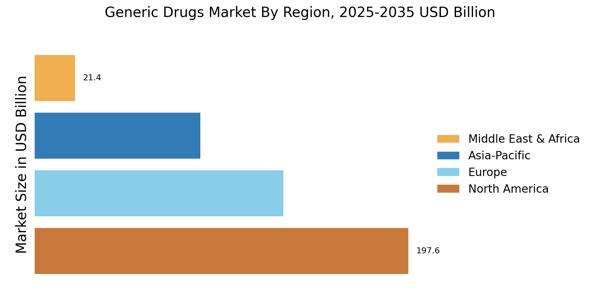

- The North American region remains the largest market for generic drugs, reflecting a strong demand for cost-effective healthcare solutions.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rising healthcare access and affordability.

- Oncology continues to dominate as the largest segment, while the Central Nervous System segment is witnessing the fastest growth due to increasing prevalence of neurological disorders.

- Rising healthcare costs and an aging population are significant drivers propelling the demand for generic drugs across various segments.

Market Size & Forecast

| 2024 Market Size | 437.9 (USD Billion) |

| 2035 Market Size | 1171.71 (USD Billion) |

| CAGR (2025 - 2035) | 9.36% |

Major Players

Teva Pharmaceutical Industries (IL), Sandoz (CH), Mylan (US), Amgen (US), Sun Pharmaceutical Industries (IN), Aurobindo Pharma (IN), Cipla (IN), Lupin (IN), Hikma Pharmaceuticals (GB), Dr. Reddy's Laboratories (IN)