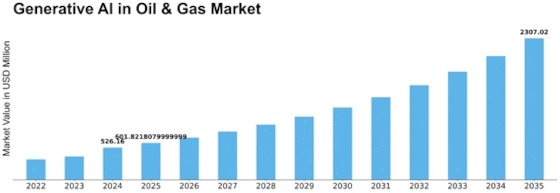

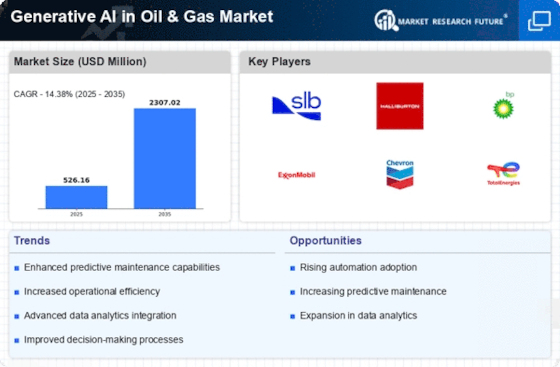

Generative Ai In Oil Gas Size

Generative AI in Oil & Gas Market Growth Projections and Opportunities

Generative AI, a subset of artificial intelligence (AI) that focuses on creating new data rather than analyzing existing data, is making significant strides in transforming the oil and gas market dynamics. In this industry, which heavily relies on data-driven decision-making, generative AI is proving to be a game-changer. One key area where generative AI is making an impact is in the optimization of exploration and production processes. By leveraging vast amounts of geological and seismic data, generative AI algorithms can simulate various drilling scenarios, helping oil and gas companies identify the most promising locations for extraction.

Moreover, generative AI is revolutionizing the field of reservoir modeling. Traditionally, building accurate reservoir models required significant time and resources. However, with the advent of generative AI, companies can now generate detailed 3D models of underground reservoirs more quickly and efficiently. These models not only improve the understanding of subsurface structures but also enable better reservoir management strategies, ultimately leading to increased production rates and reduced operational costs.

Furthermore, generative AI is enhancing predictive maintenance practices within the oil and gas sector. By analyzing sensor data from equipment such as pumps, valves, and turbines, AI algorithms can detect anomalies and predict potential failures before they occur. This proactive approach to maintenance not only minimizes downtime but also extends the lifespan of critical assets, resulting in substantial cost savings for oil and gas companies.

In addition to operational efficiencies, generative AI is driving innovation in the realm of sustainability and environmental stewardship. By optimizing drilling and extraction processes, AI algorithms can help reduce the environmental footprint of oil and gas operations. For example, by minimizing the number of wells drilled and optimizing extraction techniques, companies can mitigate the impact on sensitive ecosystems and reduce greenhouse gas emissions.

Moreover, generative AI is facilitating the development of next-generation materials and fuels that are more efficient and environmentally friendly. By analyzing vast datasets on chemical compositions and material properties, AI algorithms can design novel materials with enhanced durability, corrosion resistance, and thermal conductivity. Similarly, AI-driven simulations can optimize the composition of biofuels and synthetic fuels, making them more efficient and cost-effective alternatives to traditional fossil fuels.

However, despite the numerous benefits that generative AI offers, its widespread adoption in the oil and gas industry is not without challenges. One major hurdle is the need for massive amounts of high-quality data to train AI algorithms effectively. In an industry where data availability can be limited, especially in remote exploration sites, acquiring and curating the necessary datasets can be a daunting task. Additionally, there are concerns surrounding data privacy and security, especially when dealing with sensitive geological and operational data.

Furthermore, there is a skills gap within the industry, with a shortage of professionals who possess the expertise to develop and deploy generative AI solutions effectively. Bridging this gap will require significant investment in training and education programs focused on AI and data science.

Leave a Comment