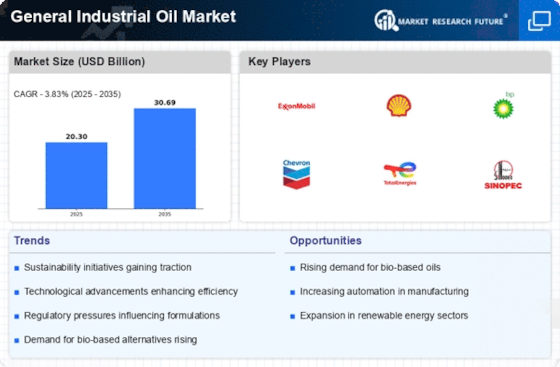

Growth of Renewable Energy Sector

The growth of the renewable energy sector is emerging as a significant driver for the General Industrial Oil Market. As the world transitions towards sustainable energy sources, the demand for industrial oils used in renewable energy applications, such as wind and solar power, is likely to increase. In 2025, the renewable energy sector is projected to require a diverse range of lubricants for machinery and equipment, potentially leading to a market growth of around 4% in this segment. This trend not only reflects the broader shift towards sustainability but also highlights the evolving applications of industrial oils in new and innovative sectors.

Increased Focus on Equipment Efficiency

An increased focus on equipment efficiency is a critical driver for the General Industrial Oil Market. Industries are continuously seeking ways to enhance operational efficiency and reduce downtime, which directly influences the demand for high-quality industrial oils. In 2025, it is estimated that the market for oils designed to improve equipment performance will grow by approximately 5.5%. This focus on efficiency is driven by the need to maximize productivity and minimize costs, prompting companies to invest in superior lubricants that can withstand extreme conditions and extend equipment life. As such, the demand for specialized industrial oils is likely to rise, shaping the competitive landscape of the market.

Rising Demand from Manufacturing Sector

The manufacturing sector plays a pivotal role in driving the General Industrial Oil Market. As industries expand and modernize, the need for high-performance lubricants and oils increases. In 2025, the manufacturing sector is projected to account for a substantial share of the overall demand for industrial oils, with estimates suggesting a growth rate of approximately 4.5% annually. This growth is attributed to the increasing complexity of machinery and the need for efficient operation, which necessitates the use of specialized oils. Furthermore, the trend towards automation and advanced manufacturing processes further propels the demand for high-quality industrial oils, thereby enhancing the overall market landscape.

Technological Advancements in Oil Formulation

Technological advancements in oil formulation are significantly influencing the General Industrial Oil Market. Innovations in synthetic oils and additives have led to the development of products that offer superior performance and longevity. In 2025, the market for synthetic industrial oils is expected to grow by around 6%, driven by their enhanced properties such as better thermal stability and reduced volatility. These advancements not only improve machinery efficiency but also contribute to lower maintenance costs for industries. As companies increasingly seek to optimize their operations, the demand for technologically advanced oils is likely to rise, shaping the future of the market.

Regulatory Compliance and Environmental Standards

Regulatory compliance and environmental standards are becoming increasingly stringent, impacting the General Industrial Oil Market. Governments worldwide are implementing regulations aimed at reducing environmental impact, which necessitates the use of eco-friendly lubricants and oils. By 2025, it is anticipated that the market for biodegradable and environmentally safe industrial oils will witness a growth rate of approximately 5%. This shift towards sustainable practices not only aligns with corporate social responsibility goals but also influences purchasing decisions across various sectors. As industries adapt to these regulations, the demand for compliant products is expected to rise, thereby shaping market dynamics.