Rising Urbanization

Rising urbanization in the GCC region is significantly influencing the visual positioning system market. As urban populations grow, cities are increasingly adopting smart technologies to manage infrastructure and services effectively. Visual positioning systems are integral to urban planning and management, providing critical data for traffic management, public safety, and environmental monitoring. For instance, cities like Dubai and Riyadh are implementing smart city initiatives that rely on advanced positioning technologies to enhance urban living. The increasing complexity of urban environments necessitates precise positioning solutions to address challenges such as congestion and resource allocation. Market analysts suggest that the urbanization trend will continue to drive demand for visual positioning systems, as municipalities seek to improve the quality of life for residents while optimizing city operations. This growing focus on smart urban development presents a substantial opportunity for stakeholders in the visual positioning system market.

Government Initiatives

Government initiatives play a pivotal role in the growth of the GCC visual positioning system market. Various GCC countries are investing heavily in smart city projects, which necessitate the deployment of advanced visual positioning systems. For example, the UAE's Vision 2021 aims to enhance the quality of life through innovative technologies, including those related to positioning systems. Additionally, Saudi Arabia's Vision 2030 emphasizes the importance of technology in diversifying the economy, which includes the development of smart infrastructure. These initiatives are supported by regulatory frameworks that encourage the adoption of cutting-edge technologies. As a result, the market is witnessing increased funding and support from both public and private sectors, which is likely to accelerate the deployment of visual positioning systems across the region. This collaborative effort between governments and industry stakeholders is expected to drive significant growth in the coming years.

Technological Advancements

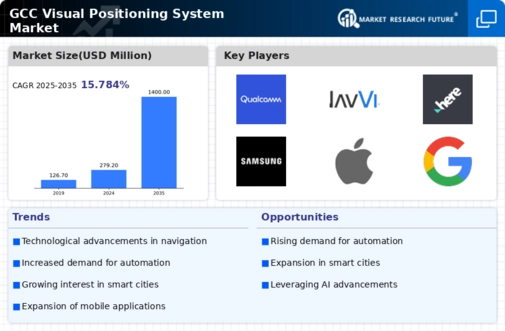

The GCC visual positioning system market is experiencing rapid technological advancements that are reshaping its landscape. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the accuracy and efficiency of visual positioning systems. For instance, the integration of high-resolution cameras and advanced algorithms allows for real-time data processing, which is crucial for applications in autonomous vehicles and smart cities. According to recent data, the market is projected to grow at a compound annual growth rate of 15% over the next five years, driven by these technological improvements. Furthermore, the adoption of 5G technology is expected to facilitate faster data transmission, thereby improving the performance of visual positioning systems. This convergence of technologies not only enhances operational capabilities but also opens new avenues for applications across various sectors, including transportation, retail, and urban planning.

Increased Demand in Logistics

The GCC visual positioning system market is witnessing a surge in demand within the logistics sector. As e-commerce continues to expand, companies are increasingly seeking efficient solutions for inventory management and supply chain optimization. Visual positioning systems provide real-time tracking and monitoring capabilities, which are essential for enhancing operational efficiency. According to market data, the logistics sector in the GCC is projected to grow by 10% annually, further fueling the need for advanced positioning technologies. Companies are leveraging these systems to streamline their operations, reduce costs, and improve customer satisfaction. Moreover, the integration of visual positioning systems with existing logistics software is becoming more prevalent, allowing for seamless data exchange and improved decision-making. This trend indicates a strong potential for growth in the visual positioning system market as logistics companies strive to meet the demands of a rapidly evolving marketplace.

Integration with IoT Solutions

The integration of visual positioning systems with Internet of Things (IoT) solutions is emerging as a key driver in the GCC visual positioning system market. As IoT devices proliferate, the need for accurate positioning data becomes increasingly critical for various applications, including smart homes, industrial automation, and transportation. Visual positioning systems enhance the functionality of IoT devices by providing precise location data, which is essential for real-time monitoring and control. The GCC region is witnessing a rapid increase in IoT adoption, with projections indicating a growth rate of 20% annually. This trend is likely to create synergies between visual positioning systems and IoT technologies, leading to innovative applications and improved operational efficiencies. Furthermore, the collaboration between technology providers and IoT solution developers is expected to foster the development of integrated systems that leverage the strengths of both technologies, thereby driving growth in the visual positioning system market.