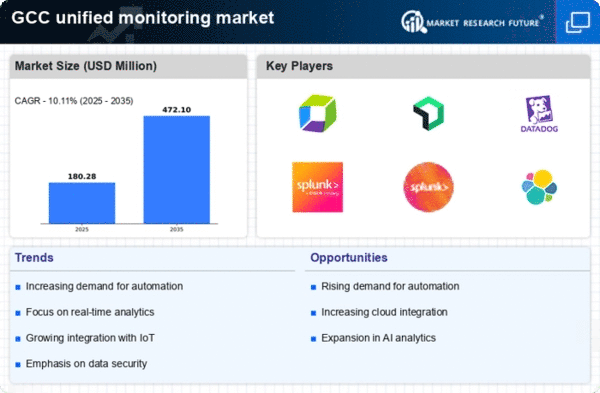

The unified monitoring market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for real-time data analytics and performance optimization across various sectors. Key players such as Dynatrace (US), New Relic (US), and Datadog (US) are strategically positioned to leverage their technological advancements and innovative solutions. Dynatrace (US) focuses on AI-driven monitoring solutions, enhancing user experience and operational efficiency, while New Relic (US) emphasizes its comprehensive observability platform, catering to a diverse clientele. Datadog (US) continues to expand its cloud-based monitoring capabilities, integrating seamlessly with various cloud services, which collectively shapes a competitive environment that prioritizes innovation and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing their operations to better serve regional markets, optimizing supply chains to enhance efficiency. The market appears moderately fragmented, with several players vying for market share, yet the influence of major companies remains substantial. This competitive structure allows for a diverse range of offerings, catering to different customer needs and preferences, while also fostering innovation through competition.

In October 2025, Dynatrace (US) announced a strategic partnership with a leading cloud service provider to enhance its AI capabilities, which is expected to significantly improve its monitoring solutions. This move not only strengthens Dynatrace's market position but also aligns with the growing trend of integrating AI into monitoring solutions, thereby enhancing operational efficiency for clients. The partnership is likely to attract new customers seeking advanced analytics and performance optimization.

In September 2025, New Relic (US) launched a new feature that integrates machine learning algorithms into its observability platform, allowing for predictive analytics. This development is crucial as it positions New Relic at the forefront of the market, enabling clients to anticipate issues before they arise, thus minimizing downtime and enhancing service reliability. Such innovations are indicative of the company's commitment to maintaining a competitive edge through technological advancement.

In August 2025, Datadog (US) expanded its product suite by acquiring a cybersecurity firm, which enhances its monitoring capabilities by integrating security features into its existing platform. This acquisition reflects a strategic move to address the growing concerns around cybersecurity, thereby providing clients with a more comprehensive monitoring solution. The integration of security into monitoring services is becoming increasingly vital as organizations seek to protect their digital assets.

As of November 2025, the competitive trends in the unified monitoring market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their offerings and address evolving customer demands. Looking ahead, competitive differentiation is likely to shift from price-based strategies to a focus on innovation, technological advancements, and supply chain reliability, as organizations strive to provide superior value to their clients.

Leave a Comment