Emergence of Mobile Solutions

The tax accounting-software market is experiencing a shift towards mobile solutions, reflecting the growing trend of mobile technology adoption in the GCC. Businesses are increasingly seeking tax software that can be accessed on mobile devices, allowing for greater flexibility and convenience. This trend is particularly appealing to small and medium-sized enterprises (SMEs) that require cost-effective solutions without compromising functionality. The rise of mobile applications is expected to drive growth in the tax accounting-software market, as more companies recognize the benefits of managing tax processes on-the-go. As mobile technology continues to evolve, the demand for mobile-friendly tax solutions is likely to increase, further influencing market dynamics.

Growing Demand for Automation

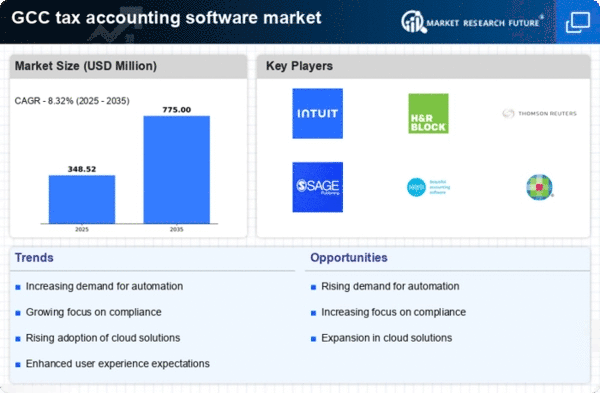

The tax accounting-software market is experiencing a notable surge in demand for automation solutions. Businesses in the GCC are increasingly seeking software that can streamline tax processes, reduce manual errors, and enhance efficiency. Automation not only saves time but also minimizes compliance risks associated with tax regulations. According to recent data, the adoption of automated tax solutions has increased by approximately 30% in the last year alone. This trend indicates a shift towards more sophisticated software that can handle complex tax scenarios, thereby driving growth in the tax accounting-software market. As companies strive to optimize their operations, the demand for automated solutions is likely to continue rising, further propelling the market forward.

Increased Focus on Data Security

The tax accounting-software market is witnessing a heightened focus on data security as businesses become more aware of the risks associated with data breaches. With sensitive financial information being processed, companies in the GCC are prioritizing software solutions that offer robust security features. This trend is driven by the need to protect client data and maintain compliance with data protection regulations. As a result, software providers are investing in advanced security measures, such as encryption and multi-factor authentication, to enhance their offerings. The emphasis on data security is likely to shape the future of the tax accounting-software market, as businesses seek solutions that not only streamline tax processes but also safeguard their information.

Rising Complexity of Tax Regulations

The tax accounting-software market is significantly influenced by the increasing complexity of tax regulations within the GCC. Governments are continuously updating tax laws, which necessitates that businesses remain compliant with the latest requirements. This complexity creates a demand for software that can adapt to changing regulations and provide accurate calculations. For instance, the introduction of Value Added Tax (VAT) in several GCC countries has led to a heightened need for specialized tax software. Companies are investing in solutions that can ensure compliance and reduce the risk of penalties. As the regulatory landscape evolves, the tax accounting-software market is expected to grow as businesses seek reliable tools to navigate these complexities.

Shift Towards Digital Transformation

The tax accounting-software market is benefiting from the broader trend of digital transformation across various sectors in the GCC. Organizations are increasingly recognizing the importance of integrating digital solutions to enhance operational efficiency and improve decision-making processes. This shift is prompting businesses to invest in advanced tax software that offers features such as real-time reporting and data analytics. The market is projected to grow by approximately 25% over the next five years as companies prioritize digital solutions to stay competitive. The emphasis on digital transformation is likely to drive innovation within the tax accounting-software market, leading to the development of more user-friendly and efficient applications.