Growing Aging Population

The demographic shift towards an aging population in the GCC is a crucial factor driving the tachycardia market. As life expectancy increases, the incidence of age-related health issues, including tachycardia, is also on the rise. Reports indicate that by 2030, the proportion of individuals aged 60 and above in the GCC is projected to reach 20%, which correlates with a higher prevalence of cardiovascular conditions. This demographic trend is likely to create a substantial demand for specialized healthcare services and products tailored to manage tachycardia. Consequently, healthcare providers and pharmaceutical companies are expected to focus on developing innovative therapies and monitoring solutions, thereby enhancing the overall market landscape for tachycardia management.

Increased Awareness and Education

The rising awareness regarding heart health and the importance of early diagnosis is a pivotal driver for the tachycardia market. Educational campaigns and community outreach programs in the GCC are playing a vital role in informing the public about the risks associated with tachycardia and other cardiovascular conditions. As individuals become more knowledgeable about symptoms and treatment options, the demand for medical consultations and interventions is expected to rise. This heightened awareness is likely to lead to an increase in the number of patients seeking diagnosis and treatment for tachycardia, thereby expanding the market. Additionally, partnerships between healthcare providers and educational institutions are fostering a culture of proactive health management, further supporting the growth of the tachycardia market.

Advancements in Medical Technology

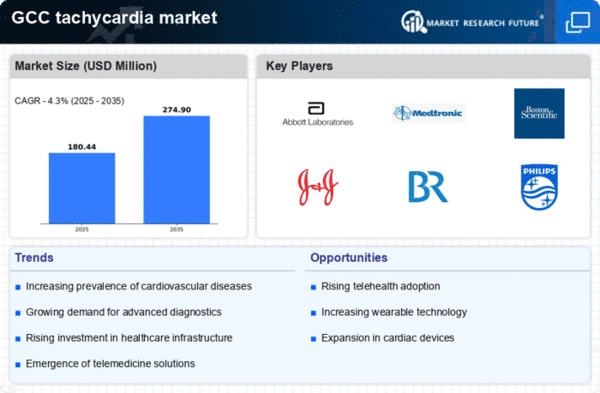

Technological innovations in medical devices and treatment methodologies are transforming the tachycardia market. The introduction of advanced monitoring systems, such as wearable devices and mobile health applications, is enabling real-time tracking of heart rates and arrhythmias. These technologies not only empower patients to manage their conditions more effectively but also facilitate timely interventions by healthcare professionals. The market for such devices is anticipated to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years. Furthermore, the integration of artificial intelligence in diagnostic tools is likely to enhance the accuracy of tachycardia detection, thereby driving market growth as healthcare providers adopt these cutting-edge solutions.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases in the GCC region is a primary driver for the tachycardia market. According to health statistics, cardiovascular diseases account for a significant portion of mortality rates, with estimates suggesting that they contribute to over 30% of deaths in some GCC countries. This alarming trend necessitates enhanced diagnostic and therapeutic solutions for conditions like tachycardia. As healthcare systems respond to this growing burden, investments in advanced medical technologies and treatment options are likely to surge, thereby propelling the tachycardia market forward. Furthermore, the rising awareness among the population regarding heart health is expected to drive demand for effective management solutions, creating a robust market environment for tachycardia-related products and services.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving healthcare infrastructure in the GCC are significantly influencing the tachycardia market. Various national health strategies are being implemented to enhance cardiovascular care, including the establishment of specialized cardiac centers and the promotion of public health campaigns. For instance, the GCC governments are investing heavily in healthcare reforms, with budgets exceeding $100 billion allocated for health sector improvements. These initiatives are likely to facilitate better access to diagnostic tools and treatment options for tachycardia, thereby expanding the market. Additionally, regulatory frameworks that support innovation in medical devices and pharmaceuticals are expected to further stimulate growth in the tachycardia market, as new technologies become available to healthcare providers.