Growing Regulatory Pressures

The software defined-security market is increasingly shaped by growing regulatory pressures in the GCC. Governments are implementing stringent regulations to safeguard sensitive data and ensure compliance with international standards. Organizations are compelled to adopt software defined-security solutions that not only meet regulatory requirements but also enhance their overall security posture. The introduction of data protection laws has led to a surge in demand for compliance-driven security solutions. As businesses navigate the complexities of regulatory frameworks, the software defined-security market is likely to expand, driven by the need for solutions that facilitate compliance while mitigating risks associated with data breaches.

Rising Cyber Threat Landscape

The software defined-security market is experiencing heightened demand due to an increasingly complex cyber threat landscape. Cyberattacks are becoming more sophisticated, targeting critical infrastructure and sensitive data. In the GCC region, the number of reported cyber incidents has surged, prompting organizations to seek advanced security solutions. According to recent data, the GCC has witnessed a 30% increase in cyber threats over the past year. This alarming trend compels businesses to invest in software defined-security solutions that offer real-time threat detection and response capabilities. As organizations strive to protect their digital assets, the software defined-security market is poised for substantial growth, driven by the urgent need for enhanced security measures.

Shift Towards Digital Transformation

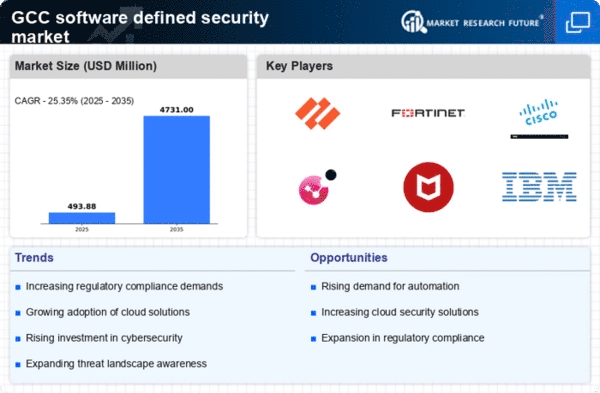

The ongoing digital transformation across various sectors in the GCC is significantly influencing the software defined-security market. As organizations increasingly adopt digital technologies, the attack surface expands, necessitating robust security frameworks. The transition to digital platforms has led to a projected growth of 25% in the software defined-security market by 2026. Companies are recognizing that traditional security measures are insufficient in addressing the challenges posed by digital environments. Consequently, there is a growing emphasis on integrating software defined-security solutions that can adapt to dynamic digital landscapes. This shift not only enhances security posture but also aligns with broader organizational goals of innovation and efficiency.

Emergence of Managed Security Services

The software defined-security market is witnessing a notable shift towards managed security services in the GCC. Organizations are increasingly outsourcing their security needs to specialized providers, allowing them to focus on core business functions. This trend is driven by the growing complexity of cyber threats and the shortage of skilled cybersecurity professionals. Managed security service providers (MSSPs) are leveraging software defined-security technologies to deliver comprehensive security solutions. The market for managed security services is projected to grow by 20% annually, indicating a strong preference for outsourced security solutions. This evolution not only enhances security capabilities but also positions the software defined-security market for sustained growth as organizations seek efficient and effective security management.

Increased Investment in IT Infrastructure

The software defined-security market is benefiting from substantial investments in IT infrastructure within the GCC. Governments and private sectors are allocating significant budgets to enhance their technological capabilities, with a focus on cybersecurity. Recent reports indicate that IT spending in the GCC is expected to reach $30 billion by 2026, with a considerable portion directed towards security solutions. This influx of capital is likely to drive the adoption of software defined-security technologies, as organizations seek to fortify their defenses against emerging threats. The emphasis on building resilient IT infrastructures creates a favorable environment for the software defined-security market to thrive, as businesses prioritize security in their technology investments.