Technological Advancements

The GCC school campus security market is experiencing a notable shift due to rapid technological advancements. The integration of advanced surveillance systems, such as AI-driven cameras and biometric access controls, enhances the ability to monitor and secure school environments. In 2025, the market for security technology in educational institutions in the GCC region was valued at approximately USD 1.2 billion, reflecting a growing emphasis on safety. Furthermore, the adoption of cloud-based security solutions allows for real-time data access and incident response, which is crucial for maintaining a secure campus. As educational institutions increasingly prioritize student safety, the demand for innovative security technologies is likely to rise, driving growth in the GCC school campus security market.

Government Regulations and Policies

Government regulations and policies play a pivotal role in shaping the GCC school campus security market. In recent years, various GCC countries have implemented stringent safety regulations aimed at enhancing the security of educational institutions. For instance, the Ministry of Education in Saudi Arabia has mandated the installation of surveillance systems in all schools, which has led to a surge in demand for security solutions. Additionally, the UAE has introduced guidelines for emergency preparedness and response, further emphasizing the need for robust security measures. These regulatory frameworks not only ensure compliance but also foster a culture of safety within schools, thereby propelling the growth of the GCC school campus security market.

Collaboration with Local Authorities

Collaboration with local authorities is emerging as a crucial driver in the GCC school campus security market. Schools are increasingly partnering with law enforcement agencies to develop effective security strategies and response plans. This collaboration not only enhances the overall safety of educational institutions but also fosters a sense of community involvement. For example, in Qatar, schools have established joint safety committees with local police to conduct regular safety drills and training sessions. Such initiatives not only improve preparedness but also build trust between schools and law enforcement. As these partnerships become more prevalent, they are likely to contribute to the growth and evolution of the GCC school campus security market.

Increased Awareness of Safety Issues

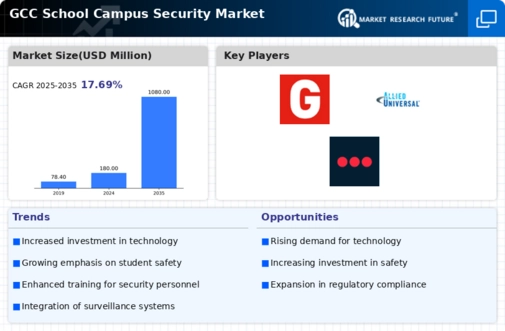

The heightened awareness of safety issues among parents, educators, and students is significantly influencing the GCC school campus security market. Recent surveys indicate that over 70% of parents in the region express concerns regarding their children's safety at school. This growing apprehension has prompted educational institutions to invest in comprehensive security measures, including the hiring of security personnel and the implementation of emergency response protocols. As a result, the market for school security services in the GCC is projected to grow at a compound annual growth rate (CAGR) of 8% over the next five years. This trend underscores the importance of addressing safety concerns, thereby driving demand within the GCC school campus security market.

Investment in Security Infrastructure

Investment in security infrastructure is a key driver of growth in the GCC school campus security market. Educational institutions are increasingly allocating budgets for upgrading their security systems, including the installation of access control systems, alarm systems, and perimeter security measures. In 2025, it was reported that GCC countries collectively invested over USD 500 million in school security infrastructure, reflecting a commitment to creating safer learning environments. This trend is expected to continue as schools recognize the importance of safeguarding students and staff. Moreover, the integration of smart technologies into security infrastructure is likely to enhance operational efficiency and response times, further propelling the GCC school campus security market.