Digital Payment Innovations

The remittance Market is experiencing a transformation due to the rapid adoption of digital payment technologies. In the GCC, mobile wallets and online transfer platforms are gaining traction, with a reported increase of 30% in digital transactions over the past year. This shift towards digital solutions is driven by the convenience and speed they offer, appealing to tech-savvy expatriates. As the region's infrastructure continues to improve, the remittance Market is likely to see further growth, with digital channels becoming the preferred method for money transfers. The integration of blockchain technology may also enhance security and reduce transaction costs, potentially reshaping the competitive landscape.

Growing Expatriate Population

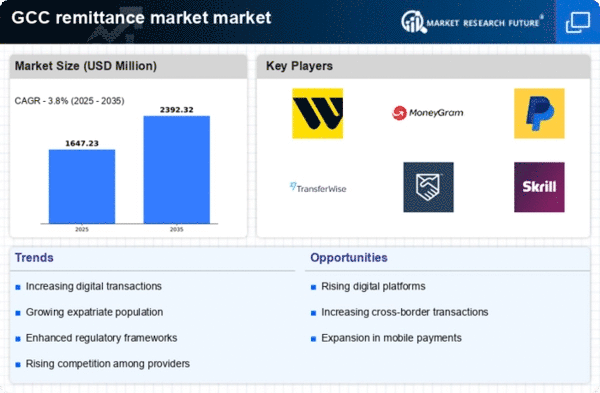

The remittance Market in the GCC is significantly influenced by the increasing number of expatriates residing in the region. As of 2025, expatriates constitute approximately 70% of the total population in countries like the UAE and Qatar. This demographic trend drives demand for remittance services, as expatriates often send money back to their home countries to support families and invest in local economies. The remittance Market in the GCC is projected to reach $50 billion by 2026, reflecting the financial flows from these expatriates. The sustained growth in this population segment suggests a robust future for remittance services, as the need for efficient and cost-effective transfer solutions becomes paramount.

Economic Diversification Efforts

The GCC countries are actively pursuing economic diversification strategies to reduce reliance on oil revenues. This shift is expected to bolster the remittance Market as new job opportunities arise in various sectors, attracting more expatriates. For instance, initiatives like Saudi Vision 2030 aim to create a more vibrant economy, which could lead to an influx of skilled workers. As these expatriates contribute to the local economy, their remittance activities are likely to increase, further stimulating the market. The remittance Market could see a growth rate of 5% annually as these diversification efforts take effect, indicating a positive outlook for the industry.

Rising Consumer Awareness and Education

Consumer awareness regarding remittance services is on the rise in the GCC, driven by educational campaigns and increased access to information. As expatriates become more informed about their options, they are likely to seek out the most cost-effective and reliable services. This trend is reflected in a 20% increase in inquiries about remittance options over the past year. The remittance Market stands to gain from this heightened awareness, as consumers demand greater transparency and competitive pricing. Providers that adapt to these changing consumer preferences may capture a larger market share, indicating a dynamic shift in the industry landscape.

Regulatory Support for Financial Inclusion

Regulatory frameworks in the GCC are increasingly supportive of financial inclusion, which is a crucial driver for the remittance Market. Governments are implementing policies that facilitate easier access to banking services for expatriates, thereby enhancing their ability to send money home. For example, initiatives aimed at reducing transaction fees and improving transparency in remittance services are gaining momentum. This regulatory support is likely to expand the customer base for remittance providers, as more individuals gain access to formal financial channels. The remittance Market could benefit from a projected increase of 15% in user engagement as these policies take root, fostering a more inclusive financial environment.