Regulatory Compliance and Standards

The necessity for compliance with industry regulations and standards is increasingly influencing the outsourced software-testing market. In the GCC, businesses are required to adhere to various local and international regulations, which necessitates rigorous testing processes. This compliance ensures that software products meet safety, security, and performance benchmarks. As regulatory scrutiny intensifies, companies are turning to specialized testing services to navigate these complexities. The market for compliance-driven testing is expected to expand, as organizations recognize the importance of mitigating risks associated with non-compliance. This trend not only enhances the credibility of software products but also reinforces the role of outsourced testing services in maintaining industry standards.

Rising Demand for Quality Assurance

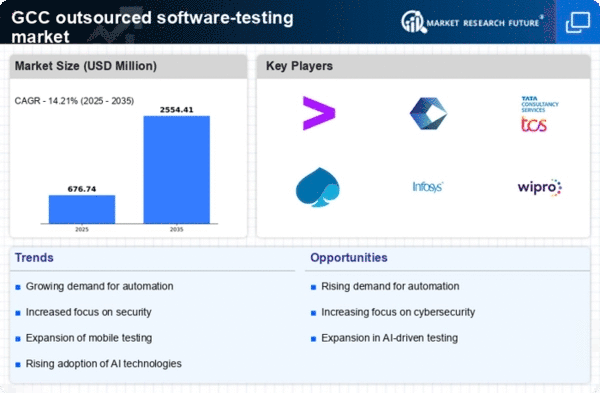

The increasing complexity of software applications has led to a heightened demand for quality assurance in the outsourced software-testing market. Companies in the GCC are recognizing that robust testing processes are essential to ensure software reliability and performance. As a result, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth is driven by the need for businesses to deliver high-quality products that meet customer expectations. Furthermore, the emphasis on user experience has prompted organizations to invest more in testing services, thereby expanding the outsourced software-testing market. The focus on quality assurance is not merely a trend but a necessity for companies aiming to maintain competitiveness in a rapidly evolving digital landscape.

Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver in the outsourced software-testing market. Organizations in the GCC are increasingly outsourcing testing functions to reduce operational costs while optimizing resource allocation. By leveraging external expertise, companies can focus on their core competencies, thereby enhancing overall productivity. The potential savings from outsourcing testing services can reach up to 30%, allowing businesses to reallocate funds towards innovation and development. This trend is particularly pronounced among small to medium-sized enterprises that may lack the resources to maintain in-house testing teams. Consequently, the drive for cost efficiency is likely to sustain the growth of the outsourced software-testing market, as more organizations seek to balance quality with financial prudence.

Technological Advancements in Testing Tools

Technological advancements are reshaping the landscape of the outsourced software-testing market. The introduction of sophisticated testing tools and frameworks has enabled more efficient and effective testing processes. Automation tools, in particular, are gaining traction, allowing for faster test execution and improved accuracy. In the GCC, the adoption of these technologies is expected to enhance the capabilities of testing service providers, making them more attractive to businesses seeking reliable testing solutions. The integration of advanced analytics and reporting tools further empowers organizations to make data-driven decisions regarding software quality. As technology continues to evolve, the outsourced software-testing market is likely to experience significant transformation, driven by the demand for innovative testing methodologies.

Growing Focus on Agile Development Practices

The shift towards agile development methodologies is significantly impacting the outsourced software-testing market. In the GCC, organizations are increasingly adopting agile practices to enhance collaboration and speed up the software development lifecycle. This shift necessitates a corresponding evolution in testing strategies, as traditional testing approaches may not align with agile principles. Consequently, there is a growing demand for testing services that can seamlessly integrate into agile workflows. The ability to provide continuous testing and rapid feedback loops is becoming a critical factor for success. As more companies embrace agile methodologies, the outsourced software-testing market is poised for growth, driven by the need for adaptive and responsive testing solutions.