Government Initiatives and Funding

Government initiatives aimed at enhancing healthcare infrastructure in the GCC are playing a crucial role in the growth of the optical imaging market. Various national health programs are being implemented to improve diagnostic capabilities and access to advanced medical technologies. For instance, substantial investments are being made in healthcare facilities to integrate state-of-the-art optical imaging systems. This influx of funding is expected to boost the market, with estimates suggesting that government spending on healthcare technology could increase by 15% in the coming years. Such initiatives not only enhance the quality of care but also stimulate the optical imaging market by fostering innovation and encouraging the adoption of new technologies.

Rising Demand for Non-Invasive Procedures

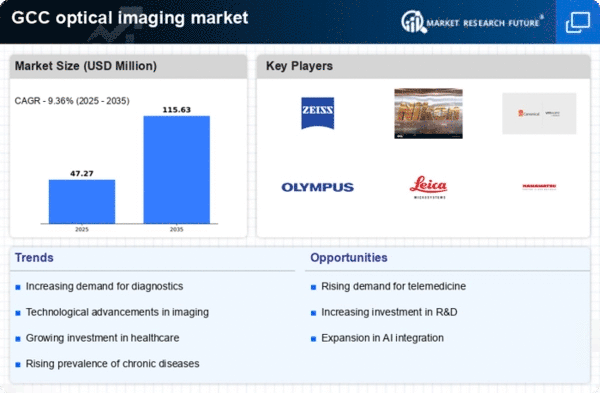

The optical imaging market is experiencing a notable increase in demand for non-invasive diagnostic procedures. This trend is largely driven by the growing awareness among patients and healthcare providers regarding the benefits of non-invasive techniques, which minimize patient discomfort and reduce recovery times. In the GCC region, healthcare facilities are increasingly adopting optical imaging technologies to enhance diagnostic accuracy and improve patient outcomes. The market for optical imaging in the GCC is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the rising preference for advanced imaging solutions. As healthcare providers seek to offer more efficient and patient-friendly services, the optical imaging market is likely to expand significantly.

Increased Focus on Early Disease Detection

The optical imaging market is benefiting from a heightened focus on early disease detection, particularly in the GCC region. As healthcare providers recognize the importance of early diagnosis in improving treatment outcomes, there is a growing demand for advanced imaging technologies that facilitate timely detection of diseases. Optical imaging modalities, such as optical coherence tomography and fluorescence imaging, are increasingly being utilized in various medical fields, including oncology and cardiology. This shift towards preventive healthcare is likely to drive market growth, with projections indicating that the optical imaging market could reach a valuation of $1 billion by 2027 in the GCC. The emphasis on early detection is expected to further propel the adoption of optical imaging solutions.

Technological Innovations in Imaging Systems

Technological innovations are significantly influencing the optical imaging market, particularly in the GCC. The introduction of advanced imaging systems, such as high-resolution cameras and sophisticated software algorithms, is enhancing the capabilities of optical imaging technologies. These innovations enable healthcare professionals to obtain clearer and more detailed images, thereby improving diagnostic accuracy. Furthermore, the integration of artificial intelligence and machine learning into imaging systems is streamlining workflows and enhancing image analysis. As a result, healthcare providers in the GCC are increasingly investing in these cutting-edge technologies, which is likely to drive the optical imaging market forward. The market is expected to witness a growth rate of around 10% annually as these innovations continue to evolve.

Growing Applications in Research and Development

The optical imaging market is witnessing a surge in applications within research and development sectors, particularly in the GCC. Academic institutions and research organizations are increasingly utilizing optical imaging technologies for various scientific studies, including biomedical research and material science. The ability to visualize biological processes at the cellular level is proving invaluable for researchers, leading to enhanced understanding and innovation. This trend is likely to contribute to the growth of the optical imaging market, as investments in research are projected to increase by 12% over the next few years. The expanding applications in R&D not only foster advancements in optical imaging technologies but also create new opportunities for market players.