Growing Focus on Telehealth Services

The microservices healthcare market is witnessing a growing focus on telehealth services, particularly in the GCC region. As healthcare systems evolve, the demand for remote consultations and virtual care solutions is increasing. Microservices architecture supports the development of scalable telehealth platforms that can accommodate fluctuating patient volumes. This flexibility is crucial for healthcare providers aiming to deliver timely and efficient care. Market analysis suggests that the telehealth market in the GCC is set to expand significantly, with estimates indicating a potential growth rate of over 25% annually. This trend is likely to drive further adoption of microservices solutions tailored for telehealth applications.

Enhanced Data Security and Compliance

In the microservices healthcare market, the emphasis on data security and compliance is intensifying. With the increasing digitization of health records, healthcare organizations in the GCC are prioritizing the implementation of microservices to ensure robust data protection. Regulatory frameworks, such as the Health Insurance Portability and Accountability Act (HIPAA), necessitate stringent compliance measures. Microservices architecture allows for better data management and security protocols, which are essential for safeguarding sensitive patient information. As a result, healthcare providers are likely to invest in microservices solutions that enhance their security posture while ensuring compliance with local and international regulations.

Investment in Health IT Infrastructure

Investment in health IT infrastructure is a critical driver for the microservices healthcare market in the GCC. Governments and private entities are increasingly allocating resources to modernize healthcare systems, which includes the adoption of microservices architecture. This investment is aimed at enhancing interoperability, improving patient care, and reducing operational costs. Reports indicate that the GCC health IT market is expected to grow to approximately $7 billion by 2025, with a substantial portion of this funding directed towards microservices solutions. As healthcare organizations seek to optimize their IT frameworks, the microservices healthcare market is likely to benefit from this influx of capital.

Rising Demand for Digital Health Solutions

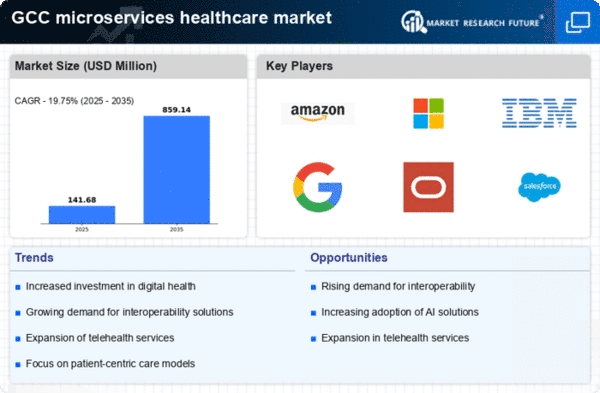

The microservices healthcare market is experiencing a notable surge in demand for digital health solutions across the GCC region. This trend is driven by an increasing population that is becoming more health-conscious and tech-savvy. As healthcare providers seek to enhance patient engagement and streamline operations, the adoption of microservices architecture is seen as a viable solution. Reports indicate that the GCC digital health market is projected to reach approximately $10 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 20%. This growth is likely to propel the microservices healthcare market, as organizations leverage these technologies to improve service delivery and operational efficiency.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies into the microservices healthcare market is becoming increasingly prevalent. These technologies enable healthcare providers in the GCC to analyze vast amounts of data, leading to improved patient outcomes and operational efficiencies. AI and ML can facilitate predictive analytics, personalized medicine, and enhanced decision-making processes. As healthcare organizations recognize the potential of these technologies, investments in microservices that support AI and ML capabilities are expected to rise. This trend may contribute to a more agile and responsive healthcare system, ultimately benefiting patients and providers alike.