Expansion of Medical Tourism

The GCC Medical Devices Market is benefiting from the expansion of medical tourism, as the region positions itself as a hub for high-quality healthcare services. Countries like the UAE and Qatar are attracting international patients seeking advanced medical treatments, which in turn drives demand for state-of-the-art medical devices. The medical tourism market in the GCC is projected to reach USD 20 billion by 2026, indicating a robust growth trajectory. This influx of patients necessitates the availability of cutting-edge medical technologies, thereby creating opportunities for manufacturers and suppliers within the GCC Medical Devices Market. The collaboration between healthcare providers and device manufacturers is likely to enhance service offerings and improve patient outcomes.

Increasing Healthcare Expenditure

The GCC Medical Devices Market is experiencing a notable increase in healthcare expenditure across the region. Governments in GCC countries are allocating larger budgets to healthcare, driven by a growing population and rising prevalence of chronic diseases. For instance, the healthcare spending in Saudi Arabia is projected to reach USD 50 billion by 2026, reflecting a commitment to enhancing healthcare infrastructure. This increase in funding is likely to facilitate the procurement of advanced medical devices, thereby stimulating market growth. Furthermore, the emphasis on improving healthcare quality and accessibility is expected to drive demand for innovative medical technologies, positioning the GCC Medical Devices Market for substantial expansion in the coming years.

Government Initiatives and Support

The GCC Medical Devices Market is significantly influenced by government initiatives aimed at enhancing healthcare systems. Various GCC governments are implementing policies to promote local manufacturing of medical devices, thereby reducing dependency on imports. For example, the Saudi Vision 2030 initiative emphasizes the development of a robust healthcare sector, which includes fostering local production of medical technologies. This strategic focus is expected to create a conducive environment for the growth of the GCC Medical Devices Market. Additionally, government support in the form of funding and incentives for research and development is likely to spur innovation and attract investments, further bolstering the market.

Integration of Digital Health Technologies

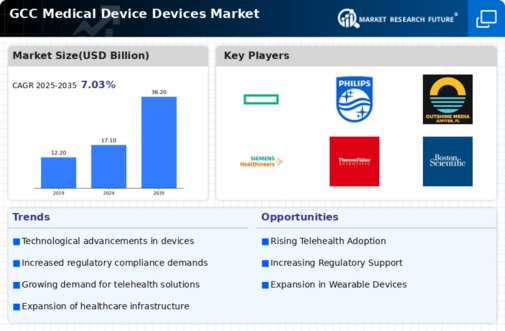

The GCC Medical Devices Market is increasingly integrating digital health technologies, which are transforming the way healthcare is delivered. The adoption of telemedicine, mobile health applications, and wearable devices is on the rise, driven by the need for efficient healthcare solutions. The digital health market in the GCC is anticipated to grow at a CAGR of 15% from 2026 to 2031, indicating a strong trend towards technology-driven healthcare. This integration not only enhances patient engagement but also improves the efficiency of medical devices. As healthcare providers increasingly leverage digital tools, the GCC Medical Devices Market is likely to witness a paradigm shift, fostering innovation and improving patient outcomes.

Rising Demand for Home Healthcare Solutions

The GCC Medical Devices Market is witnessing a surge in demand for home healthcare solutions, driven by an aging population and a shift towards patient-centered care. As more individuals prefer receiving medical care at home, the market for home medical devices, such as monitoring equipment and mobility aids, is expanding. Reports indicate that the home healthcare market in the GCC is expected to grow at a CAGR of 10% from 2026 to 2031. This trend is likely to encourage manufacturers to innovate and develop devices tailored for home use, thereby enhancing the overall market landscape. The increasing focus on chronic disease management at home further underscores the potential for growth within the GCC Medical Devices Market.