Growing Focus on Sustainability

The increasing emphasis on sustainability in the GCC is a significant driver for the IoT monetization market.. As governments and organizations strive to meet environmental goals, IoT solutions are being recognized for their potential to optimize resource usage and reduce waste. For example, smart energy management systems and waste management solutions are gaining traction, allowing businesses to monitor and manage their environmental impact effectively. This focus on sustainability not only aligns with global trends but also opens new avenues for monetization through eco-friendly services and products. Companies that can integrate sustainability into their IoT offerings are likely to find a competitive edge in the evolving market landscape, thereby enhancing the growth prospects of the iot monetization market.

Rising Demand for Smart Devices

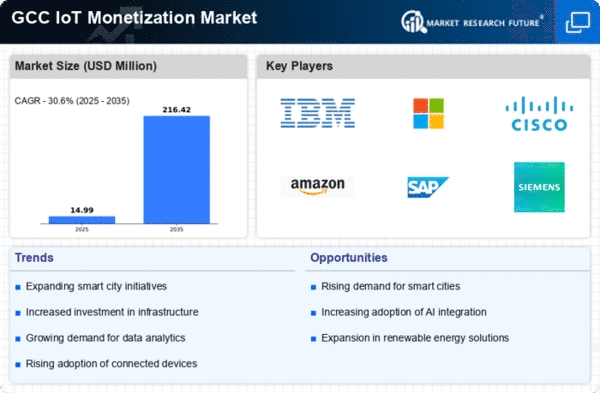

The increasing adoption of smart devices across various sectors in the GCC drives the IoT monetization market.. As consumers and businesses alike embrace smart technologies, the need for effective monetization strategies becomes evident. In 2025, the number of connected devices in the region is projected to reach over 1 billion, indicating a substantial market opportunity. This surge in device connectivity necessitates innovative monetization models that can capitalize on the data generated by these devices. Companies are exploring diverse revenue streams, including subscription services and data analytics, to enhance profitability. The growing demand for smart home solutions, wearables, and industrial IoT applications further fuels this trend, suggesting that the iot monetization market will continue to expand as more devices come online.

Government Initiatives and Support

Government initiatives in the GCC are playing a crucial role in shaping the iot monetization market. Various national strategies aim to promote digital transformation and smart city projects, which inherently rely on IoT technologies. For instance, the UAE's Vision 2021 and Saudi Arabia's Vision 2030 emphasize the importance of technology in economic diversification. These initiatives are likely to create a conducive environment for businesses to innovate and monetize IoT solutions. Financial incentives, regulatory frameworks, and public-private partnerships are being established to support the growth of IoT ecosystems. As a result, the iot monetization market is expected to benefit from increased investment and collaboration, potentially leading to a more robust and dynamic market landscape.

Increased Investment in Cybersecurity

As the iot monetization market expands, the need for robust cybersecurity measures becomes increasingly critical. The rise in connected devices and data exchange raises concerns about data privacy and security breaches. In response, businesses in the GCC are investing heavily in cybersecurity solutions to protect their IoT infrastructures. This investment is likely to drive the development of secure IoT platforms and services, which can be monetized effectively. By ensuring data integrity and user trust, companies can enhance their value propositions and attract more customers. The focus on cybersecurity not only mitigates risks but also creates opportunities for new revenue streams in the iot monetization market, as organizations seek to offer secure and reliable IoT solutions.

Advancements in Connectivity Technologies

Rapid advancements in connectivity technologies, such as 5G and LPWAN, significantly impact the IoT monetization market.. These technologies enable faster data transmission and improved network reliability, which are essential for the effective functioning of IoT applications. In the GCC, the rollout of 5G networks is anticipated to enhance the capabilities of IoT devices, allowing for real-time data processing and analytics. This improved connectivity is likely to drive the adoption of IoT solutions across various industries, including healthcare, transportation, and manufacturing. As businesses leverage these technologies, the potential for monetization through enhanced services and data insights increases, suggesting a promising outlook for the iot monetization market.