Advancements in AI Technology

Technological advancements in AI are significantly influencing the GCC generative ai in media entertainment market. The emergence of sophisticated algorithms and machine learning techniques enables media companies to produce high-quality content with greater efficiency. For example, AI-driven tools can analyze viewer preferences and generate scripts or visual content that aligns with audience expectations. Reports suggest that the integration of AI in content creation can reduce production time by up to 30%, allowing companies to respond swiftly to market trends. This technological evolution not only enhances the creative process but also optimizes resource allocation, making it a crucial driver for the growth of the industry.

Emergence of New Revenue Models

The GCC generative ai in media entertainment market is witnessing the emergence of innovative revenue models driven by AI capabilities. As traditional advertising revenues face challenges, media companies are exploring alternative monetization strategies, such as subscription-based models and pay-per-view services. Generative AI facilitates the creation of unique content that can be monetized effectively, appealing to niche audiences. For instance, AI-generated interactive experiences can command premium pricing, thereby enhancing revenue streams. This shift towards diversified revenue models not only supports the sustainability of media companies but also reflects the changing dynamics of consumer preferences in the entertainment landscape.

Government Support and Investment

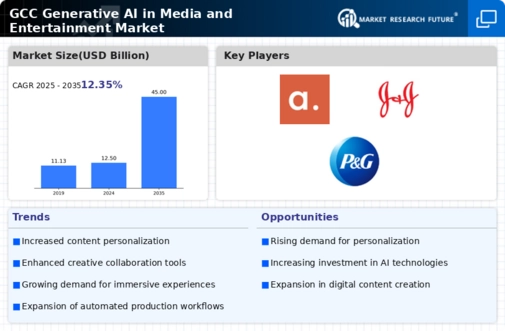

Government initiatives across the GCC are playing a pivotal role in the growth of the generative ai in media entertainment market. Countries like Saudi Arabia and the UAE have launched strategic plans to foster innovation in the digital economy, with substantial investments directed towards AI technologies. For instance, the Saudi Vision 2030 aims to diversify the economy and enhance the entertainment sector, which includes significant funding for AI-driven projects. This supportive regulatory environment encourages media companies to adopt generative AI solutions, facilitating the development of new content formats and enhancing production capabilities. As a result, the industry is likely to experience accelerated growth driven by both public and private sector investments.

Rising Demand for Localized Content

The GCC generative ai in media entertainment market is witnessing a notable increase in demand for localized content. As diverse populations across the Gulf region seek entertainment that resonates with their cultural backgrounds, media companies are leveraging generative AI to create tailored narratives and experiences. This trend is supported by data indicating that over 60% of consumers in the GCC prefer content that reflects their local culture and language. Consequently, media firms are investing in AI technologies to automate the localization process, thereby enhancing viewer engagement and satisfaction. The ability to generate culturally relevant content not only meets consumer preferences but also positions companies competitively in a rapidly evolving market.

Increased Investment in Digital Platforms

The GCC generative ai in media entertainment market is experiencing a surge in investment directed towards digital platforms. As consumer behavior shifts towards online streaming and digital consumption, media companies are recognizing the need to enhance their digital offerings. This shift is evidenced by the fact that digital media consumption in the GCC has grown by over 40% in recent years. Generative AI plays a vital role in this transformation, enabling companies to create interactive and engaging content that captivates audiences. By investing in AI technologies, media firms can develop personalized viewing experiences, thereby increasing subscriber retention and attracting new audiences. This trend indicates a robust future for the industry as digital platforms continue to evolve.