Growing Data Complexity

The enterprise metadata-management market is experiencing a surge in demand due to the increasing complexity of data generated by organizations in the GCC. As businesses expand their operations and adopt digital transformation strategies, the volume and variety of data have escalated. This complexity necessitates robust metadata management solutions to ensure data is accurately cataloged, easily accessible, and effectively utilized. According to recent estimates, the data generated in the GCC is projected to grow by over 30% annually, highlighting the urgent need for effective metadata management. Organizations are recognizing that without proper metadata management, they risk inefficiencies and potential data mismanagement, which could lead to significant financial losses. Thus, the growing data complexity is a primary driver for the enterprise metadata-management market, as companies seek to streamline their data processes and enhance operational efficiency.

Demand for Enhanced Data Quality

The enterprise metadata-management market is also driven by the growing demand for enhanced data quality among organizations in the GCC. As businesses increasingly rely on data for strategic decision-making, the accuracy and reliability of that data become paramount. Poor data quality can lead to misguided business strategies and financial losses. Consequently, organizations are investing in metadata management solutions that provide comprehensive data profiling, cleansing, and validation capabilities. It is estimated that poor data quality costs organizations in the GCC an average of $15 million annually, underscoring the financial implications of inadequate data management. By prioritizing data quality through effective metadata management, organizations can improve their operational performance and achieve better business outcomes.

Emergence of Cloud-Based Solutions

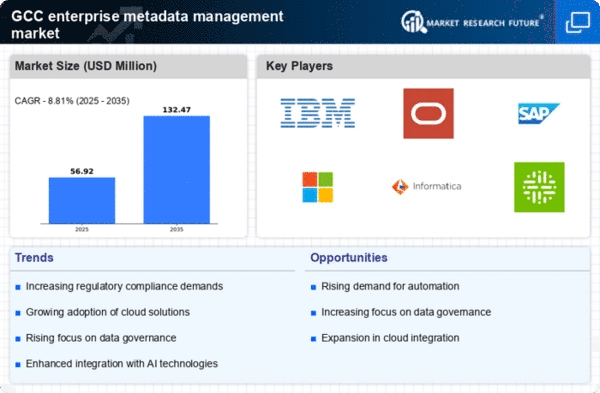

The enterprise metadata-management market is witnessing a shift towards cloud-based solutions, driven by the increasing adoption of cloud computing in the GCC. Organizations are migrating their data and applications to the cloud to enhance scalability, flexibility, and cost-effectiveness. This transition necessitates robust metadata management to ensure that data stored in the cloud is properly organized and easily retrievable. Cloud-based metadata management solutions offer organizations the ability to manage their metadata across various cloud environments seamlessly. As cloud adoption continues to rise, it is projected that the enterprise metadata-management market will grow by over 25% in the next five years, as businesses seek to leverage cloud technologies while maintaining effective data governance and management practices.

Regulatory Compliance Requirements

In the GCC, the enterprise metadata-management market is significantly influenced by stringent regulatory compliance requirements. Governments and regulatory bodies are increasingly mandating organizations to adhere to data protection and privacy laws, such as the General Data Protection Regulation (GDPR) and local data protection regulations. These compliance requirements necessitate comprehensive metadata management solutions that can track data lineage, ensure data accuracy, and facilitate audits. Organizations that fail to comply with these regulations may face hefty fines, which can reach up to €20 million or 4% of their annual global turnover, whichever is higher. As a result, the demand for enterprise metadata-management solutions is likely to rise, as businesses strive to implement systems that not only meet compliance standards but also enhance their overall data governance frameworks.

Increased Investment in Digital Transformation

The enterprise metadata-management market is benefiting from the heightened investment in digital transformation initiatives across the GCC. Organizations are increasingly recognizing the value of leveraging data analytics and artificial intelligence to drive business growth and innovation. This shift towards digitalization requires effective metadata management to ensure that data is organized, accessible, and usable for analytical purposes. Recent reports indicate that companies in the GCC are expected to invest over $10 billion in digital transformation by 2026, creating a substantial market opportunity for metadata management solutions. As businesses embark on their digital journeys, the need for robust metadata management systems becomes critical to support data-driven decision-making and enhance operational efficiencies.