Rising Demand for Automation

The electronic contract-assembly market is experiencing a notable surge in demand for automation solutions. Businesses in the GCC region are increasingly seeking to streamline their contract management processes, which has led to a growing interest in automated contract assembly tools. This trend is driven by the need for efficiency and accuracy in contract creation, as manual processes are often prone to errors. According to recent data, the automation of contract processes can reduce time spent on contract management by up to 50%. As organizations strive to enhance productivity, the electronic contract-assembly market is likely to benefit from this shift towards automation.

Regulatory Compliance Pressure

In the GCC, regulatory compliance is becoming increasingly stringent, compelling organizations to adopt electronic contract-assembly solutions. The electronic contract-assembly market is responding to the heightened need for compliance with local laws and international standards. Companies are investing in contract management systems that ensure adherence to legal requirements, thereby minimizing risks associated with non-compliance. The market is projected to grow as businesses recognize the importance of maintaining compliance in their contractual agreements. This trend is expected to drive a significant portion of the demand for electronic contract-assembly solutions in the region.

Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver for the electronic contract-assembly market in the GCC. Organizations are under constant pressure to reduce operational costs while maintaining high-quality service delivery. The adoption of electronic contract-assembly solutions allows businesses to minimize expenses associated with paper-based processes, storage, and manual labor. By transitioning to digital contract management, companies can achieve substantial savings, with estimates suggesting a reduction in contract processing costs by as much as 30%. This focus on cost efficiency is likely to propel the growth of the electronic contract-assembly market.

Enhanced Collaboration Capabilities

The electronic contract-assembly market is benefiting from the growing need for enhanced collaboration among stakeholders. In the GCC, businesses are increasingly recognizing the importance of collaborative contract management, which allows multiple parties to contribute to and review contracts in real-time. This collaborative approach not only speeds up the contract creation process but also improves accuracy and reduces the likelihood of disputes. As organizations seek to foster better communication and teamwork, the demand for electronic contract-assembly solutions that facilitate collaboration is expected to rise, further driving market growth.

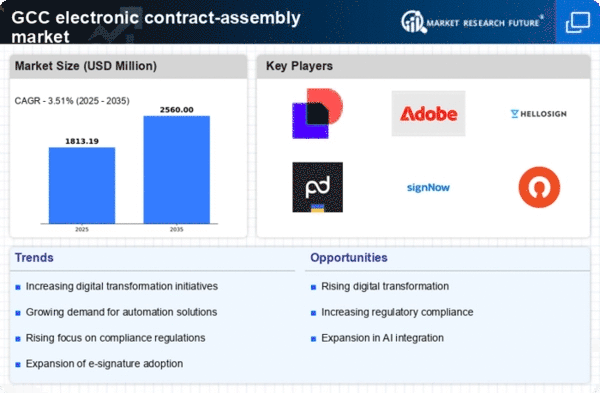

Shift Towards Digital Transformation

The ongoing digital transformation across various sectors in the GCC is significantly impacting the electronic contract-assembly market. Organizations are increasingly adopting digital tools to enhance their operational efficiency and customer engagement. This shift is characterized by the integration of advanced technologies such as artificial intelligence and machine learning into contract management processes. As businesses seek to modernize their operations, the electronic contract-assembly market is likely to see a rise in demand for innovative solutions that facilitate seamless contract creation and management. This trend indicates a broader movement towards digitization in the region.