Focus on Infection Control

Infection control remains a paramount concern within the GCC disposable endoscope market. The rising incidence of healthcare-associated infections has prompted healthcare facilities to prioritize the use of single-use devices, including disposable endoscopes. This focus on infection prevention is supported by various health authorities in the GCC, which advocate for stringent sterilization protocols. Data indicates that hospitals utilizing disposable endoscopes report a reduction in infection rates by up to 30%. As a result, the demand for disposable endoscopes is expected to increase, as they provide a viable solution to mitigate the risks associated with reusable devices. The emphasis on infection control not only enhances patient safety but also aligns with the broader goals of healthcare systems in the GCC to improve overall healthcare quality.

Growing Healthcare Expenditure

The GCC disposable endoscope market is benefiting from the increasing healthcare expenditure across the region. Governments in GCC countries are investing heavily in healthcare infrastructure, aiming to enhance service delivery and patient care. For instance, the healthcare expenditure in the GCC is projected to reach USD 100 billion by 2026, reflecting a commitment to improving healthcare services. This increase in funding is likely to facilitate the procurement of advanced medical devices, including disposable endoscopes. As healthcare facilities expand and modernize, the demand for disposable endoscopes is expected to grow, driven by the need for efficient and effective diagnostic tools. The rising healthcare expenditure not only supports the growth of the disposable endoscope market but also aligns with the broader objectives of enhancing healthcare quality in the GCC.

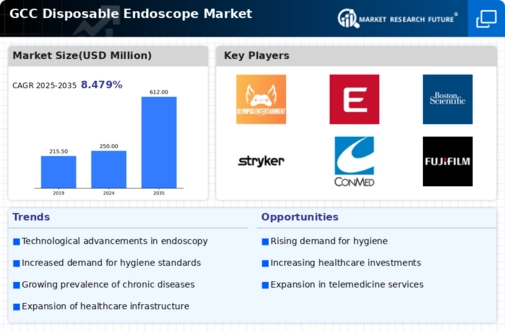

Technological Advancements in Endoscopy

Technological advancements are playing a pivotal role in shaping the GCC disposable endoscope market. Innovations such as high-definition imaging, flexible designs, and enhanced maneuverability are making disposable endoscopes more effective and user-friendly. The integration of advanced technologies is expected to drive market growth, as healthcare providers seek to improve diagnostic accuracy and patient outcomes. Recent studies suggest that the adoption of technologically advanced disposable endoscopes can lead to a 20% increase in diagnostic efficiency. As healthcare facilities in the GCC invest in state-of-the-art equipment, the demand for high-quality disposable endoscopes is likely to rise, further propelling the market forward. This trend underscores the importance of continuous innovation in meeting the needs of modern healthcare.

Regulatory Support for Disposable Devices

The regulatory landscape in the GCC region is increasingly supportive of disposable medical devices, including endoscopes. Health authorities are implementing policies that facilitate the approval and adoption of innovative medical technologies. For instance, the Gulf Cooperation Council (GCC) has established a unified regulatory framework that streamlines the process for bringing disposable endoscopes to market. This regulatory support is crucial for manufacturers, as it reduces time-to-market and encourages investment in research and development. As a result, the GCC disposable endoscope market is likely to witness an influx of new products that meet the evolving needs of healthcare providers. The proactive stance of regulatory bodies not only fosters innovation but also enhances the overall competitiveness of the market.

Rising Demand for Minimally Invasive Procedures

The GCC disposable endoscope market is experiencing a notable surge in demand for minimally invasive procedures. This trend is largely driven by the increasing preference for procedures that reduce patient recovery time and minimize surgical risks. According to recent data, the market for minimally invasive surgeries in the GCC region is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. This growth is indicative of a broader shift towards advanced medical technologies that enhance patient outcomes. As healthcare providers in the GCC adopt these innovative techniques, the disposable endoscope market is likely to benefit significantly, as these devices are integral to performing such procedures effectively. The convenience and efficiency offered by disposable endoscopes align well with the evolving landscape of surgical practices in the region.