Rising Data Consumption

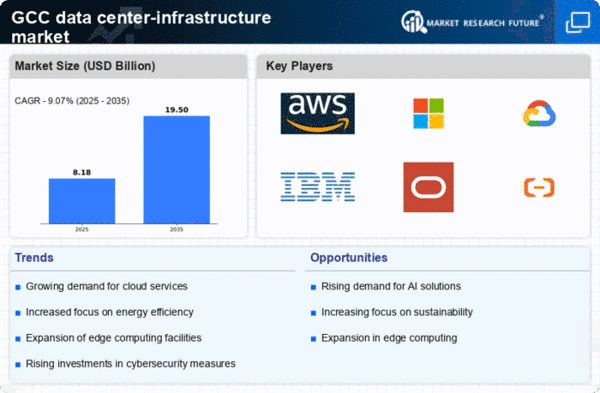

The data center-infrastructure market is experiencing a surge in demand driven by the exponential growth of data consumption across various sectors in the GCC. With the increasing reliance on digital services, the volume of data generated is projected to rise significantly. Reports indicate that data traffic in the region could increase by over 30% annually, necessitating enhanced infrastructure capabilities. This trend compels organizations to invest in robust data center solutions to manage and store vast amounts of information efficiently. As businesses seek to optimize their operations, the demand for scalable and flexible data center infrastructures becomes paramount. Consequently, this driver is likely to shape the future landscape of the data center-infrastructure market, as companies strive to meet the evolving needs of their customers.

Emergence of Edge Computing

The emergence of edge computing is significantly influencing the data center-infrastructure market in the GCC. As organizations seek to reduce latency and improve response times, the need for localized data processing is becoming increasingly apparent. Edge computing allows data to be processed closer to the source, thereby enhancing efficiency and performance. This shift is particularly relevant in sectors such as IoT, where real-time data processing is crucial. The data center-infrastructure market is adapting to this trend by developing smaller, distributed data centers that can support edge computing requirements. Analysts suggest that this could lead to a transformation in how data centers are designed and operated, ultimately driving innovation and investment in the sector.

Government Initiatives and Regulations

Government initiatives in the GCC are playing a pivotal role in shaping the data center-infrastructure market. Various national strategies aim to enhance digital transformation and promote the establishment of data centers within the region. For instance, the UAE's Vision 2021 and Saudi Arabia's Vision 2030 emphasize the importance of technology and innovation, leading to increased investments in data center infrastructure. Furthermore, regulatory frameworks are being developed to ensure data security and compliance, which could further stimulate market growth. As governments encourage private sector participation, the data center-infrastructure market is likely to witness a surge in new projects and investments, fostering a competitive environment that benefits both providers and consumers.

Increased Investment in Renewable Energy

The data center-infrastructure market is witnessing a notable shift towards renewable energy sources, driven by the growing emphasis on sustainability in the GCC. As organizations strive to reduce their carbon footprint, investments in renewable energy solutions are becoming more prevalent. Reports indicate that data centers powered by renewable energy could reduce operational costs by up to 20%, making them an attractive option for businesses. This trend not only aligns with global sustainability goals but also enhances the resilience of data center operations. As a result, the data center-infrastructure market is likely to see an influx of projects focused on integrating renewable energy solutions, thereby fostering a more sustainable and efficient operational model.

Technological Advancements in Infrastructure

Technological advancements are reshaping the data center-infrastructure market, particularly in the GCC. Innovations such as artificial intelligence, machine learning, and automation are being integrated into data center operations to enhance efficiency and reduce costs. These technologies enable predictive maintenance, optimize resource allocation, and improve overall performance. As organizations increasingly adopt these advanced technologies, the demand for modernized data center infrastructures is expected to rise. Furthermore, the integration of advanced cooling solutions and energy-efficient designs is likely to become a standard practice, driving further investment in the sector. This trend indicates a shift towards smarter, more efficient data centers that can meet the growing demands of businesses in the region.