Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver for the cloud computing-in-healthcare market in the GCC. Healthcare organizations are increasingly seeking ways to optimize resources and reduce operational costs. Cloud solutions offer scalable infrastructure that allows institutions to pay only for the services they use, which can lead to savings of up to 25% in IT expenditures. Additionally, the reduction in the need for physical storage and maintenance of on-premises servers contributes to overall cost reduction. As healthcare providers in the GCC face budget constraints, the financial advantages of cloud computing become increasingly appealing. This trend indicates a shift towards more sustainable healthcare practices, making the cloud computing-in-healthcare market a vital component of future healthcare strategies.

Rising Focus on Patient-Centric Care Models

The shift towards patient-centric care models is significantly influencing the cloud computing-in-healthcare market in the GCC. Healthcare providers are increasingly recognizing the importance of involving patients in their own care processes. Cloud technologies enable the development of personalized health applications that empower patients to manage their health proactively. This trend is reflected in the growing number of mobile health applications and patient portals that utilize cloud infrastructure. As patients demand more control over their health information, the cloud computing-in-healthcare market is likely to expand to meet these needs. This focus on patient engagement not only enhances satisfaction but also leads to better health outcomes, indicating a transformative shift in healthcare delivery.

Growing Demand for Remote Patient Monitoring

The cloud computing-in-healthcare market is experiencing a surge in demand for remote patient monitoring solutions. This trend is driven by the increasing prevalence of chronic diseases in the GCC region, which necessitates continuous health monitoring. According to recent data, approximately 30% of the population in GCC countries suffers from chronic conditions, leading to a heightened need for effective management solutions. Cloud-based platforms facilitate real-time data collection and analysis, enabling healthcare providers to offer timely interventions. This shift not only enhances patient outcomes but also reduces hospital readmission rates, thereby optimizing healthcare costs. As healthcare systems in the GCC strive for efficiency, the integration of remote monitoring technologies into the cloud computing-in-healthcare market appears to be a pivotal driver of growth.

Regulatory Support for Digital Health Initiatives

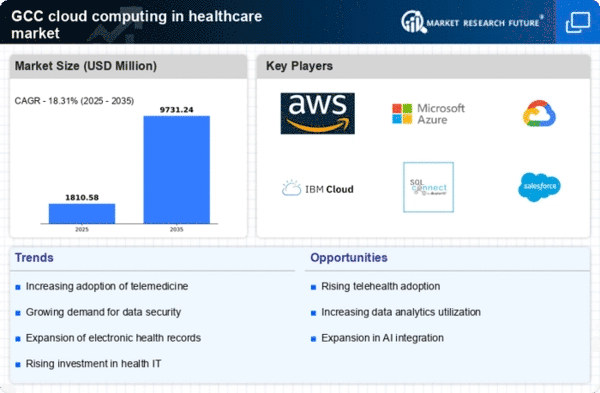

Regulatory frameworks in the GCC are increasingly supportive of digital health initiatives, which significantly impacts the cloud computing-in-healthcare market. Governments are implementing policies that encourage the adoption of cloud technologies in healthcare settings. For instance, the UAE's Ministry of Health and Prevention has launched initiatives aimed at digitizing health records and promoting telemedicine. Such regulatory support not only fosters innovation but also instills confidence among healthcare providers to invest in cloud solutions. The market is projected to grow at a CAGR of 15% over the next five years, driven by these favorable regulations. This environment encourages collaboration between public and private sectors, further propelling the cloud computing-in-healthcare market forward.

Enhanced Interoperability Among Healthcare Systems

Interoperability is a crucial factor driving the cloud computing-in-healthcare market in the GCC. The ability for different healthcare systems to communicate and share data seamlessly is essential for improving patient care. Cloud-based solutions facilitate this interoperability by providing standardized platforms that can integrate various health information systems. As healthcare providers in the GCC strive to create a more connected ecosystem, the demand for interoperable cloud solutions is likely to increase. This trend is supported by initiatives from regional health authorities aimed at creating unified health records. Enhanced interoperability not only improves clinical workflows but also supports data-driven decision-making, thereby strengthening the overall healthcare delivery system.