Focus on Workforce Development

The GCC artificial intelligence in manufacturing market is increasingly focusing on workforce development to harness the full potential of AI technologies. As AI systems become more prevalent, there is a growing need for skilled professionals who can manage and operate these technologies. Governments and private sectors are investing in training programs and educational initiatives to equip the workforce with the necessary skills. For instance, initiatives like the UAE's National Program for Artificial Intelligence aim to create a talent pool that can support the AI ecosystem. This emphasis on workforce development not only addresses the skills gap but also enhances the overall competitiveness of the GCC artificial intelligence in manufacturing market.

Technological Advancements in AI

Technological advancements in artificial intelligence are significantly influencing the GCC artificial intelligence in manufacturing market. Innovations in machine learning, computer vision, and robotics are enabling manufacturers to automate complex processes and enhance product quality. For example, the integration of AI-powered robotics in assembly lines has shown to increase efficiency by up to 30%. Furthermore, advancements in data analytics allow manufacturers to derive actionable insights from vast amounts of data, leading to improved decision-making. As technology continues to evolve, the GCC artificial intelligence in manufacturing market is expected to experience accelerated growth, with companies increasingly leveraging these advancements to optimize their operations and drive innovation.

Government Initiatives and Support

The GCC artificial intelligence in manufacturing market benefits from robust government initiatives aimed at fostering technological advancement. Countries such as Saudi Arabia and the UAE have launched national strategies, such as Saudi Vision 2030 and the UAE Artificial Intelligence Strategy, which prioritize the integration of AI in various sectors, including manufacturing. These initiatives often include funding, tax incentives, and infrastructure development to support AI adoption. For instance, the UAE aims to increase the contribution of AI to its economy by 20 billion USD by 2031. Such government backing not only enhances the growth potential of the GCC artificial intelligence in manufacturing market but also encourages private sector investment, creating a conducive environment for innovation.

Rising Demand for Smart Manufacturing Solutions

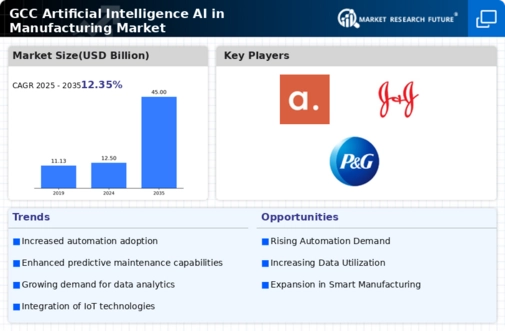

The GCC artificial intelligence in manufacturing market is witnessing a surge in demand for smart manufacturing solutions. As industries strive for operational efficiency, AI technologies such as predictive maintenance, quality control, and supply chain optimization are becoming increasingly essential. According to recent estimates, the smart manufacturing market in the GCC is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2026. This growth is driven by the need for manufacturers to reduce costs and improve productivity. Companies are increasingly adopting AI-driven tools to enhance their manufacturing processes, thereby positioning themselves competitively in the global market. The rising demand for smart manufacturing solutions is likely to propel the GCC artificial intelligence in manufacturing market forward.

Increased Investment in Research and Development

Increased investment in research and development (R&D) is a key driver for the GCC artificial intelligence in manufacturing market. Governments and private enterprises are allocating substantial resources to R&D initiatives aimed at developing innovative AI solutions tailored for the manufacturing sector. For example, the Saudi Arabian government has committed to investing billions in technology and innovation, which includes AI research. This influx of funding is likely to accelerate the development of cutting-edge AI applications that can transform manufacturing processes. As R&D efforts intensify, the GCC artificial intelligence in manufacturing market is poised for significant advancements, potentially leading to breakthroughs that enhance productivity and efficiency.