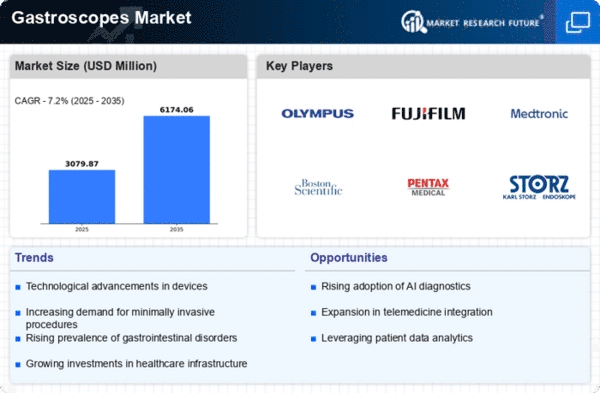

Market Growth Projections

The Global Gastroscopes Market Industry is poised for substantial growth, with projections indicating a market value of 2.87 USD Billion in 2024 and an anticipated increase to 6.17 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.21% from 2025 to 2035, reflecting the increasing adoption of gastroscopy technologies and the rising prevalence of gastrointestinal disorders. The market's expansion is likely to be fueled by technological advancements, growing healthcare expenditure, and an aging population, positioning gastroscopes as essential tools in modern diagnostic practices.

Rising Healthcare Expenditure

Increased healthcare expenditure across various regions is a significant driver for the Global Gastroscopes Market Industry. Governments and private sectors are investing more in healthcare infrastructure, leading to the procurement of advanced medical equipment, including gastroscopes. For instance, countries with robust healthcare systems are allocating substantial budgets to enhance diagnostic capabilities. This investment trend is expected to facilitate the adoption of innovative gastroscopy technologies, thereby expanding the market. As healthcare systems evolve, the demand for effective diagnostic tools like gastroscopes is likely to rise, contributing to the overall market growth.

Technological Advancements in Gastroscopy

Technological innovations are transforming the Global Gastroscopes Market Industry, enhancing the capabilities of gastroscopes. Developments such as high-definition imaging, narrow-band imaging, and capsule endoscopy are improving diagnostic precision and patient comfort. These advancements facilitate earlier detection of gastrointestinal diseases, which is crucial for effective treatment. Moreover, the integration of artificial intelligence in gastroscopy is likely to streamline procedures and reduce human error. As these technologies become more prevalent, they are expected to attract investments, further propelling the market's growth trajectory towards an estimated 6.17 USD Billion by 2035.

Aging Population and Associated Healthcare Needs

The aging population worldwide is a critical factor influencing the Global Gastroscopes Market Industry. As individuals age, they become more susceptible to gastrointestinal disorders, necessitating regular screenings and diagnostic procedures. This demographic shift is particularly pronounced in developed nations, where the proportion of elderly citizens is increasing. Consequently, healthcare providers are focusing on enhancing their diagnostic capabilities to cater to this growing patient population. The demand for gastroscopy services is expected to rise in tandem with the aging demographic, further driving market growth in the coming years.

Growing Demand for Minimally Invasive Procedures

The shift towards minimally invasive procedures is a notable trend influencing the Global Gastroscopes Market Industry. Patients increasingly prefer procedures that minimize recovery time and reduce surgical risks. Gastroscopy, being a minimally invasive diagnostic tool, aligns with this preference, leading to higher adoption rates among healthcare providers. This trend is particularly evident in developed regions where patient awareness and access to advanced medical technologies are higher. As a result, the market is projected to experience a compound annual growth rate of 7.21% from 2025 to 2035, reflecting the growing acceptance of gastroscopy as a preferred diagnostic method.

Increasing Prevalence of Gastrointestinal Disorders

The rising incidence of gastrointestinal disorders globally drives demand within the Global Gastroscopes Market Industry. Conditions such as gastroesophageal reflux disease, peptic ulcers, and colorectal cancer are becoming increasingly common, necessitating effective diagnostic tools. For instance, the World Health Organization indicates that gastrointestinal diseases account for a significant percentage of global morbidity. As a result, healthcare providers are investing in advanced gastroscopy technologies to enhance diagnostic accuracy and patient outcomes. This trend is expected to contribute to the market's growth, with projections estimating the market value to reach 2.87 USD Billion in 2024.