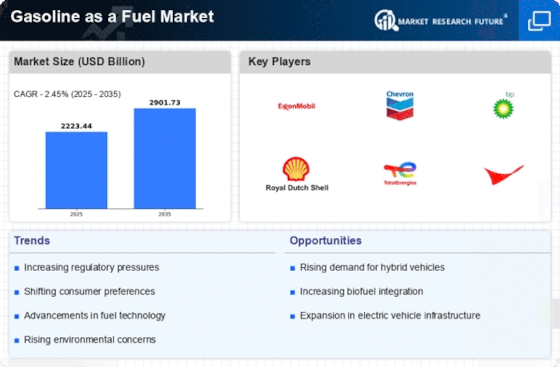

Economic Growth and Consumer Spending

Economic growth plays a pivotal role in shaping the gasoline as a fuel market. As economies expand, consumer spending typically increases, leading to higher demand for transportation and, consequently, gasoline. In 2025, many regions are experiencing a resurgence in economic activity, which is likely to drive up gasoline consumption. For instance, the U.S. Energy Information Administration forecasts that gasoline consumption will rise by approximately 1.5% in 2025, reflecting increased travel and commuting as businesses reopen and consumer confidence returns. This economic momentum suggests a sustained demand for gasoline, as individuals and businesses rely on this fuel for their daily operations and activities. However, fluctuations in oil prices and economic uncertainties could pose risks to this growth trajectory.

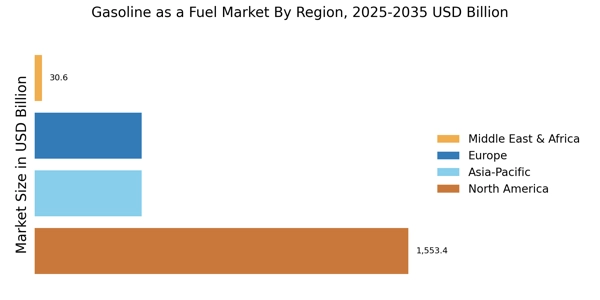

Increasing Demand for Transportation Fuels

The demand for gasoline as a fuel market is primarily driven by the transportation sector, which encompasses personal vehicles, commercial fleets, and public transportation. As urbanization continues to rise, the number of vehicles on the road is expected to increase, leading to a higher consumption of gasoline. In 2025, the International Energy Agency projects that global oil demand will reach approximately 104 million barrels per day, with gasoline accounting for a substantial portion of this figure. This trend indicates a robust market for gasoline, as consumers and businesses alike rely on this fuel for mobility. Furthermore, the expansion of road infrastructure in developing regions is likely to further bolster the gasoline market, as it facilitates greater access to transportation options.

Fluctuating Oil Prices and Market Volatility

Fluctuating oil prices are a significant driver of the gasoline as a fuel market, impacting both consumer behavior and market dynamics. In 2025, oil prices are subject to various factors, including geopolitical tensions, supply chain disruptions, and changes in production levels by major oil-producing nations. These fluctuations can lead to volatility in gasoline prices, influencing consumer purchasing decisions and overall demand. For instance, when prices rise sharply, consumers may seek to reduce their gasoline consumption or consider alternative transportation options. Conversely, lower prices may encourage increased driving and fuel consumption. This inherent volatility in the oil market creates a complex environment for stakeholders in the gasoline industry, necessitating strategic planning and adaptability to navigate the challenges and opportunities presented by changing market conditions.

Technological Innovations in Fuel Efficiency

Technological advancements in fuel efficiency are reshaping the gasoline as a fuel market. Innovations in engine design, fuel formulations, and vehicle technology are enabling consumers to achieve better mileage and lower emissions. For example, the introduction of hybrid vehicles and improvements in gasoline formulations have contributed to enhanced fuel efficiency, which may influence consumer preferences and purchasing decisions. In 2025, it is expected that the average fuel economy of new vehicles will continue to improve, potentially leading to a more efficient use of gasoline. While this may suggest a decrease in overall gasoline demand, it could also indicate a shift towards higher-quality gasoline products that meet stringent performance standards. Thus, the interplay between technology and consumer behavior remains a critical driver in the gasoline market.

Regulatory Framework and Environmental Policies

The gasoline as a fuel market is significantly influenced by regulatory frameworks and environmental policies aimed at reducing carbon emissions and promoting cleaner energy sources. Governments worldwide are implementing stricter emissions standards for vehicles, which may lead to a gradual decline in gasoline consumption as electric vehicles gain traction. However, the transition to alternative fuels is expected to be gradual, allowing gasoline to maintain its relevance in the energy mix for the foreseeable future. In 2025, it is anticipated that gasoline will still represent a considerable share of the transportation fuel market, despite the push for greener alternatives. This regulatory landscape creates both challenges and opportunities for the gasoline market, as companies adapt to evolving standards while seeking to innovate in fuel efficiency and emissions reduction.