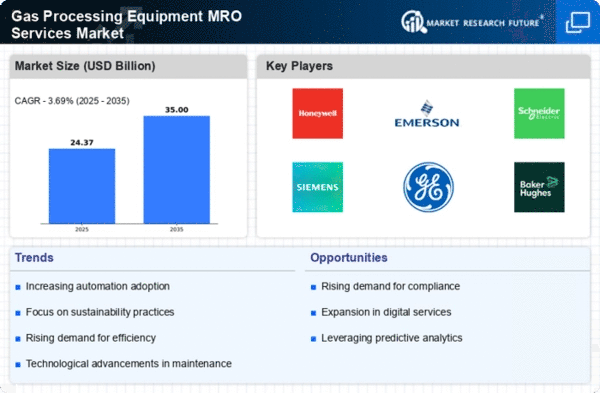

The Gas Processing Equipment MRO Services Market is characterized by a dynamic competitive landscape, driven by the increasing demand for efficient and sustainable energy solutions. Key players such as Honeywell (US), Emerson Electric (US), and Siemens (DE) are strategically positioned to leverage technological advancements and enhance operational efficiencies. These companies are focusing on innovation and digital transformation, which are pivotal in shaping their competitive strategies. For instance, the integration of AI and IoT technologies into their service offerings appears to be a common theme, enabling them to optimize maintenance processes and reduce downtime for clients.The market structure is moderately fragmented, with a mix of established players and emerging companies vying for market share. Key business tactics include localizing manufacturing to reduce costs and enhance supply chain resilience. This approach not only allows for quicker response times to market demands but also aligns with sustainability goals by minimizing transportation emissions. The collective influence of major players is significant, as they set industry standards and drive technological advancements that smaller firms often follow.

In November Honeywell (US) announced a partnership with a leading renewable energy firm to develop advanced gas processing technologies aimed at reducing carbon emissions. This strategic move underscores Honeywell's commitment to sustainability and positions it as a leader in the transition towards greener energy solutions. The collaboration is expected to enhance their service offerings and expand their market reach, particularly in regions with stringent environmental regulations.

In October Emerson Electric (US) launched a new predictive maintenance platform that utilizes machine learning algorithms to forecast equipment failures before they occur. This innovation is likely to provide clients with significant cost savings and operational efficiencies, reinforcing Emerson's reputation as a technology leader in the MRO services sector. The platform's introduction reflects a broader trend towards digitalization in the industry, where data-driven insights are becoming essential for effective asset management.

In September Siemens (DE) expanded its service portfolio by acquiring a specialized firm focused on gas processing equipment maintenance. This acquisition is indicative of Siemens' strategy to enhance its capabilities and offer comprehensive solutions to its clients. By integrating the acquired firm's expertise, Siemens aims to strengthen its competitive position and respond more effectively to the evolving needs of the market.

As of December the competitive trends in the Gas Processing Equipment MRO Services Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and enhancing service delivery. The shift from price-based competition to a focus on technological differentiation and supply chain reliability is evident, suggesting that future competitive advantages will hinge on the ability to innovate and adapt to changing market dynamics.