Geopolitical Factors

Geopolitical dynamics significantly impact the Global Gas Hydrates Market Industry. Regions rich in gas hydrate resources, such as the Arctic and offshore areas, are becoming focal points for energy exploration. Nations are increasingly vying for control over these resources, which could lead to strategic partnerships and investments. The competition for energy security drives countries to explore gas hydrates as a means to diversify their energy portfolios. This geopolitical interest may lead to increased funding and research initiatives aimed at unlocking the potential of gas hydrates, thereby enhancing their role in the global energy landscape.

Rising Energy Demand

The Global Gas Hydrates Market Industry is poised for growth due to the increasing global energy demand. As populations expand and economies develop, the need for sustainable energy sources becomes paramount. Gas hydrates, which are abundant in offshore regions, present a viable solution to meet this demand. In 2024, the market is valued at approximately 2.69 USD Billion, reflecting a growing interest in alternative energy sources. Countries like Japan and the United States are actively exploring gas hydrate resources, indicating a shift towards more sustainable energy practices. This trend suggests that gas hydrates could play a crucial role in future energy strategies.

Market Growth Projections

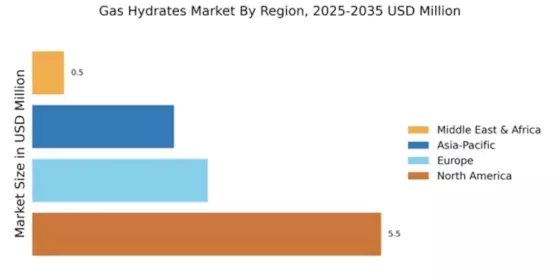

The Global Gas Hydrates Market Industry is projected to experience substantial growth in the coming years. With a market valuation of 2.69 USD Billion in 2024, it is anticipated to reach 4.66 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.1% from 2025 to 2035. Factors contributing to this growth include rising energy demands, technological advancements, and increased investments in research and development. As countries seek to diversify their energy sources and reduce carbon emissions, gas hydrates are likely to play an increasingly prominent role in the global energy mix.

Technological Advancements

Technological innovations are driving the Global Gas Hydrates Market Industry forward. Advances in drilling and extraction technologies have enhanced the feasibility of gas hydrate production. For instance, improved seismic imaging techniques allow for better identification of hydrate deposits, while enhanced extraction methods increase recovery rates. These developments not only lower operational costs but also mitigate environmental impacts, making gas hydrates a more attractive option for energy production. As these technologies continue to evolve, they may significantly contribute to the projected market growth, with estimates suggesting a market value of 4.66 USD Billion by 2035.

Environmental Considerations

The Global Gas Hydrates Market Industry is increasingly influenced by environmental considerations. As the world grapples with climate change, there is a pressing need for cleaner energy sources. Gas hydrates, which emit less carbon dioxide compared to traditional fossil fuels, are being recognized for their potential to reduce greenhouse gas emissions. This shift towards cleaner energy is evident in various national policies promoting the exploration and utilization of gas hydrates. Countries are investing in research and development to harness this resource responsibly, indicating a growing recognition of its potential role in achieving energy transition goals.

Investment in Research and Development

Investment in research and development is a crucial driver for the Global Gas Hydrates Market Industry. Governments and private entities are recognizing the potential of gas hydrates as a future energy source and are allocating significant resources towards their exploration and extraction. This focus on R&D is expected to yield breakthroughs in production techniques and environmental management, ultimately making gas hydrates more commercially viable. As a result, the market is projected to grow at a CAGR of 5.1% from 2025 to 2035, reflecting the increasing confidence in gas hydrates as a sustainable energy solution.