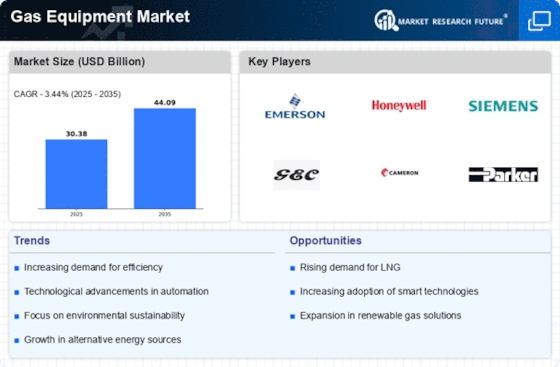

Rising Energy Demand

The increasing The Gas Equipment Industry. As populations grow and economies expand, the need for reliable energy sources intensifies. Natural gas is often viewed as a cleaner alternative to coal and oil, leading to its rising adoption in power generation and industrial applications. According to recent data, natural gas consumption is projected to grow by approximately 1.5% annually over the next decade. This trend suggests that investments in gas equipment will likely increase, as industries seek to enhance efficiency and reduce emissions. Consequently, manufacturers of gas equipment are expected to innovate and expand their product lines to meet this burgeoning demand.

Regulatory Frameworks

Regulatory frameworks are a significant driver of the Gas Equipment Market, as governments establish guidelines to ensure safety and environmental protection. Compliance with these regulations often necessitates the adoption of advanced gas equipment. For example, stringent emission standards compel industries to invest in cleaner technologies and equipment. The implementation of safety regulations also drives demand for high-quality gas equipment that meets specific standards. As regulatory bodies continue to evolve their policies, the market for gas equipment is likely to expand, as companies strive to remain compliant while optimizing their operations. This dynamic creates a robust environment for innovation and investment in the gas sector.

Technological Innovations

Technological innovations are reshaping the Gas Equipment Market, driving efficiency and safety in gas operations. Advancements in automation, monitoring systems, and smart technologies are enhancing the performance of gas equipment. For instance, the integration of IoT devices allows for real-time monitoring of gas systems, improving operational efficiency and reducing downtime. Furthermore, innovations in materials and design are leading to more durable and efficient equipment. The market for smart gas meters is also expanding, as consumers seek better energy management solutions. These technological advancements not only improve the reliability of gas supply but also create new opportunities for manufacturers to differentiate their products in a competitive landscape.

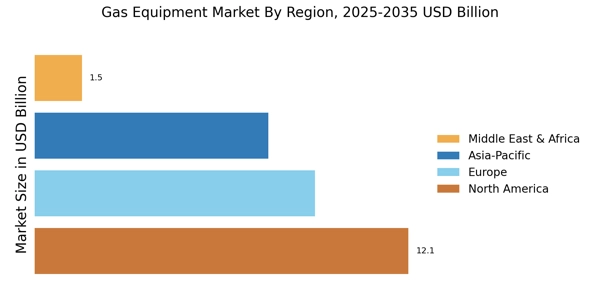

Infrastructure Development

Infrastructure development plays a crucial role in the expansion of the Gas Equipment Market. As countries invest in modernizing their energy infrastructure, the demand for gas pipelines, storage facilities, and processing plants rises. For instance, the construction of new pipelines and LNG terminals is anticipated to facilitate the transportation and distribution of natural gas. This trend is particularly evident in regions where energy access is limited. The International Energy Agency indicates that investments in gas infrastructure could reach trillions of dollars over the next decade. Such developments not only enhance energy security but also create opportunities for gas equipment manufacturers to supply advanced technologies and solutions.

Shift Towards Cleaner Fuels

The Gas Equipment Industry. Governments and organizations are increasingly prioritizing sustainability and reducing carbon footprints. Natural gas, being a cleaner-burning fossil fuel, is often seen as a transitional energy source in the move towards renewable energy. This transition is supported by various policies and incentives aimed at promoting natural gas usage. For example, many countries are implementing regulations that favor natural gas over more polluting fuels. As a result, the demand for gas equipment, such as compressors and regulators, is expected to rise, as industries adapt to these changing regulations and consumer preferences.