Rising Outdoor Living Trends

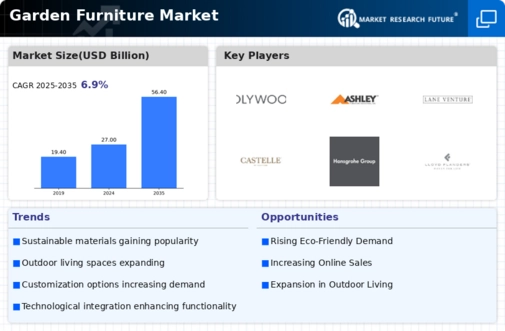

The increasing trend of outdoor living is a pivotal driver for the Garden Furniture Market. As consumers seek to enhance their outdoor spaces, the demand for stylish and functional garden furniture has surged. This trend is reflected in the growing number of homeowners investing in patios, decks, and gardens as extensions of their living areas. According to recent data, the outdoor furniture segment is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is indicative of a broader lifestyle shift towards outdoor leisure and entertainment, thereby propelling the Garden Furniture Market forward.

Urbanization and Space Optimization

Urbanization is a critical driver impacting the Garden Furniture Market. As more individuals move to urban areas, the need for space optimization in smaller living environments becomes paramount. This trend has led to an increased demand for compact and multifunctional garden furniture that maximizes utility without compromising style. Data suggests that urban dwellers are more inclined to invest in outdoor furniture that can serve multiple purposes, such as storage solutions or convertible seating. Consequently, manufacturers are adapting their product lines to meet these evolving consumer needs, thereby fostering growth within the Garden Furniture Market.

Technological Advancements in Materials

Technological advancements in materials are significantly influencing the Garden Furniture Market. Innovations such as weather-resistant fabrics, lightweight metals, and sustainable wood treatments are enhancing the durability and aesthetic appeal of garden furniture. These advancements not only improve product longevity but also cater to the growing consumer preference for low-maintenance outdoor solutions. For instance, the introduction of eco-friendly materials has resonated with environmentally conscious consumers, leading to a notable increase in sales. The market is expected to witness a rise in demand for high-performance materials, which could potentially reshape the competitive landscape of the Garden Furniture Market.

Influence of Social Media and Online Marketing

The influence of social media and online marketing is reshaping the Garden Furniture Market. Platforms such as Instagram and Pinterest have become vital for showcasing outdoor living spaces, inspiring consumers to invest in garden furniture. This visual marketing approach has led to increased brand awareness and consumer engagement, driving sales in the sector. Data indicates that brands leveraging social media effectively have seen a sales increase of up to 30% compared to those relying solely on traditional marketing methods. As online shopping continues to gain traction, the Garden Furniture Market is poised for further expansion, driven by innovative marketing strategies.

Increased Consumer Spending on Home Improvement

The rise in consumer spending on home improvement projects is a significant driver for the Garden Furniture Market. As individuals prioritize their living spaces, expenditures on outdoor furniture have seen a marked increase. Recent statistics indicate that home improvement spending has risen by approximately 10% in the last year, with a substantial portion allocated to outdoor enhancements. This trend is fueled by a desire for improved aesthetics and functionality in outdoor areas, leading to a robust demand for diverse garden furniture options. As consumers continue to invest in their homes, the Garden Furniture Market is likely to experience sustained growth.