Expansion in Industrial Applications

The GaN Laser Diode Market is expanding into various industrial applications, including material processing, laser marking, and cutting. The high power and efficiency of GaN laser diodes make them suitable for demanding industrial environments. As industries seek to enhance productivity and reduce operational costs, the adoption of laser technologies is becoming more prevalent. Market analysis indicates that the industrial segment is expected to grow at a rate of approximately 14% over the next few years. This expansion is fueled by the increasing need for precision and automation in manufacturing processes. Consequently, the GaN Laser Diode Market is poised to capitalize on this trend, with manufacturers focusing on developing tailored solutions for specific industrial needs.

Growing Demand in Medical Applications

The GaN Laser Diode Market is experiencing a surge in demand from the medical sector, particularly in applications such as laser surgery and diagnostic imaging. The unique properties of GaN laser diodes, including their ability to produce high-intensity light with minimal heat generation, make them ideal for various medical procedures. The market for medical applications is projected to grow significantly, with estimates suggesting an increase of over 10% annually. This growth is driven by the rising prevalence of chronic diseases and the need for advanced medical technologies. As healthcare providers seek to adopt more efficient and effective treatment options, the GaN Laser Diode Market is likely to benefit from this trend, leading to increased investments and innovations in medical laser technologies.

Rising Demand for Optical Communication

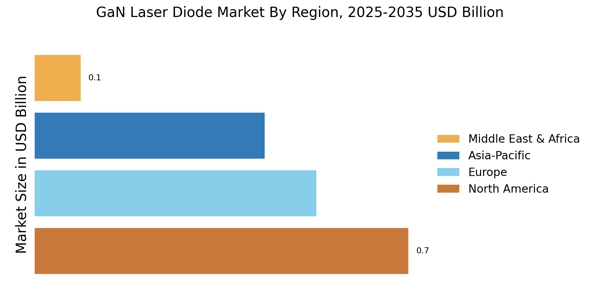

The GaN Laser Diode Market is benefiting from the rising demand for optical communication technologies. As data transmission requirements continue to escalate, the need for efficient and high-speed laser diodes is becoming increasingly critical. GaN laser diodes offer advantages such as high modulation speeds and low power consumption, making them ideal for fiber optic communication systems. Market forecasts suggest that the optical communication segment will grow at a compound annual growth rate of around 13% in the coming years. This growth is driven by the expansion of internet infrastructure and the increasing reliance on data centers. As telecommunications companies invest in upgrading their networks, the GaN Laser Diode Market is likely to see substantial growth opportunities.

Increasing Adoption in Consumer Electronics

The GaN Laser Diode Market is witnessing a notable increase in adoption within the consumer electronics sector. As devices become more compact and energy-efficient, the demand for high-performance laser diodes is on the rise. Applications such as projectors, displays, and optical storage devices are increasingly utilizing GaN laser diodes due to their superior efficiency and compact size. Market data indicates that the consumer electronics segment is expected to account for a significant share of the overall market, with projections suggesting a growth rate of around 12% annually. This trend reflects a broader shift towards miniaturization and enhanced performance in consumer devices, positioning the GaN Laser Diode Market favorably for sustained growth.

Technological Advancements in GaN Laser Diodes

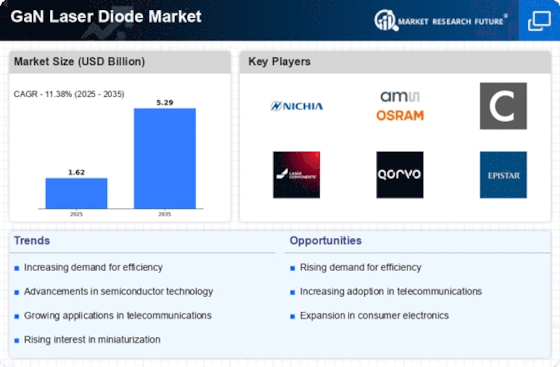

The GaN Laser Diode Market is experiencing rapid technological advancements that enhance performance and efficiency. Innovations in materials and manufacturing processes are leading to higher output power and improved thermal management. For instance, the introduction of advanced epitaxial growth techniques has resulted in diodes with better reliability and longevity. These advancements are crucial as they enable the development of high-performance laser diodes suitable for various applications, including industrial and medical sectors. The market is projected to grow at a compound annual growth rate of approximately 15% over the next five years, driven by these technological improvements. As manufacturers continue to invest in research and development, the GaN Laser Diode Market is likely to witness a surge in new product offerings, further stimulating market growth.