Market Growth Projections

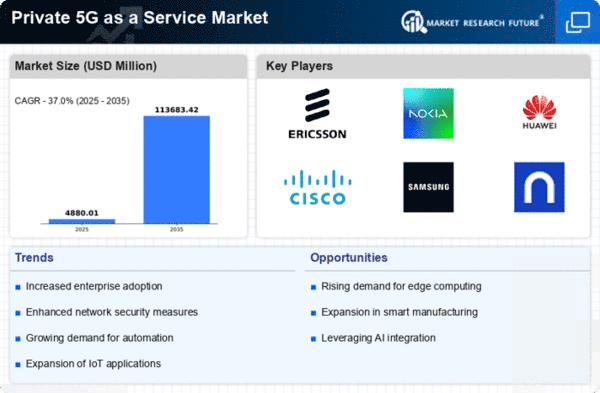

The Global Private 5G as a Service Market Industry is poised for remarkable growth, with projections indicating a market value of 3.56 USD Billion in 2024 and a staggering 113.7 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 37.01% from 2025 to 2035, driven by increasing demand for secure, high-speed connectivity across various sectors. The market's expansion is likely to be fueled by advancements in technology, regulatory support, and the rising adoption of digital transformation initiatives across industries.

Rise of Industry 4.0 and Automation

The advent of Industry 4.0 is reshaping manufacturing and industrial sectors, creating a fertile ground for the Global Private 5G as a Service Market Industry. As companies adopt automation and smart technologies, the need for reliable and high-speed connectivity becomes paramount. Private 5G networks enable real-time data exchange between machines and systems, facilitating predictive maintenance and operational optimization. This shift towards automation is anticipated to propel market growth, with projections indicating a compound annual growth rate (CAGR) of 37.01% from 2025 to 2035, underscoring the transformative potential of private 5G.

Emergence of Edge Computing Solutions

The integration of edge computing with private 5G networks is becoming increasingly relevant in the Global Private 5G as a Service Market Industry. Edge computing allows data processing to occur closer to the source, reducing latency and improving response times for critical applications. This synergy enables industries to harness real-time analytics and decision-making capabilities, particularly in sectors such as healthcare and autonomous vehicles. As organizations seek to enhance their operational efficiency and responsiveness, the adoption of edge computing in conjunction with private 5G is expected to drive substantial market growth.

Regulatory Support and Standardization

Regulatory bodies worldwide are increasingly recognizing the importance of private 5G networks, leading to supportive policies and standardization efforts. The Global Private 5G as a Service Market Industry benefits from initiatives aimed at facilitating spectrum allocation and reducing barriers to entry for private network deployments. For example, governments are exploring frameworks that allow enterprises to utilize dedicated spectrum for private 5G, enhancing network performance and reliability. This regulatory support is expected to drive adoption rates, fostering a conducive environment for market growth and innovation.

Growing Demand for Enhanced Connectivity

The Global Private 5G as a Service Market Industry is experiencing a surge in demand for enhanced connectivity solutions across various sectors. Industries such as manufacturing, healthcare, and logistics are increasingly adopting private 5G networks to support critical applications that require low latency and high reliability. For instance, smart factories leverage private 5G to enable real-time monitoring and automation, thereby improving operational efficiency. This growing demand is projected to contribute to the market's expansion, with an estimated value of 3.56 USD Billion in 2024, indicating a robust interest in private network solutions.

Increased Investment in Digital Transformation

As organizations globally prioritize digital transformation initiatives, the Global Private 5G as a Service Market Industry stands to benefit significantly. Enterprises are investing in advanced technologies such as IoT, AI, and big data analytics, which necessitate robust and secure connectivity. Private 5G networks provide the necessary infrastructure to support these technologies, ensuring seamless data transmission and enhanced security. This trend is likely to accelerate market growth, as businesses recognize the value of integrating private 5G into their digital strategies, potentially leading to a market valuation of 113.7 USD Billion by 2035.