Rising Construction Activities

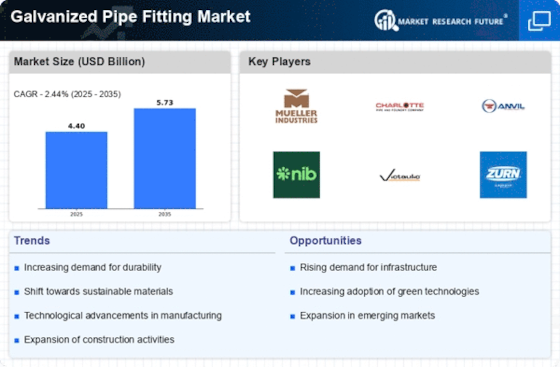

The increasing construction activities across various sectors, including residential, commercial, and industrial, are propelling the demand for the Galvanized Pipe Fitting Market. As urbanization continues to expand, the need for robust plumbing and piping systems becomes paramount. In 2025, the construction sector is projected to grow at a rate of approximately 5.5%, which directly influences the consumption of galvanized pipe fittings. These fittings are favored for their durability and resistance to corrosion, making them ideal for a variety of applications. Consequently, the surge in construction projects is likely to drive the growth of the galvanized pipe fitting market, as builders and contractors seek reliable materials to ensure the longevity of their installations.

Regulatory Standards and Compliance

The implementation of stringent regulatory standards regarding plumbing and piping systems is influencing the Galvanized Pipe Fitting Market. Governments are increasingly mandating compliance with safety and quality standards to ensure public health and environmental protection. These regulations often specify the use of materials that meet certain durability and corrosion resistance criteria. As a result, galvanized pipe fittings, which comply with these standards, are becoming more sought after in various applications. The need for compliance with these regulations is expected to drive market growth, as manufacturers and contractors prioritize the use of approved materials in their projects. This trend underscores the importance of regulatory frameworks in shaping the galvanized pipe fitting market.

Technological Innovations in Manufacturing

Technological advancements in the manufacturing processes of galvanized pipe fittings are emerging as a key driver for the Galvanized Pipe Fitting Market. Innovations such as improved galvanization techniques and automated production lines are enhancing the quality and efficiency of fittings. These advancements not only reduce production costs but also improve the performance characteristics of the fittings, making them more appealing to consumers. As manufacturers adopt these technologies, the market is likely to witness an increase in the availability of high-quality galvanized pipe fittings. This trend may lead to greater market penetration and expansion, as end-users become more aware of the benefits associated with technologically advanced products.

Industrial Growth and Manufacturing Expansion

The ongoing industrial growth and expansion of manufacturing facilities are contributing to the rising demand for the Galvanized Pipe Fitting Market. Industries such as oil and gas, chemicals, and food processing require reliable piping systems to transport fluids safely. The manufacturing sector has shown resilience, with projections indicating a growth rate of around 4% in 2025. This growth necessitates the use of galvanized pipe fittings, which are known for their ability to withstand harsh conditions and corrosive environments. As industries continue to expand, the need for durable and efficient piping solutions will likely drive the galvanized pipe fitting market further, as companies seek to enhance their operational efficiency.

Increased Water Supply and Sanitation Projects

The emphasis on improving water supply and sanitation infrastructure is a critical driver for the Galvanized Pipe Fitting Market. Governments and organizations are investing significantly in water management systems to ensure safe and reliable water access. In recent years, there has been a notable increase in funding for sanitation projects, with estimates suggesting that investments could reach billions annually. This trend is expected to continue, as the need for effective plumbing solutions becomes more pressing. Galvanized pipe fittings are often utilized in these projects due to their strength and resistance to rust, making them a preferred choice for water supply systems. As such, the growth of sanitation initiatives is likely to bolster the demand for galvanized pipe fittings.