Fuel Pumps Size

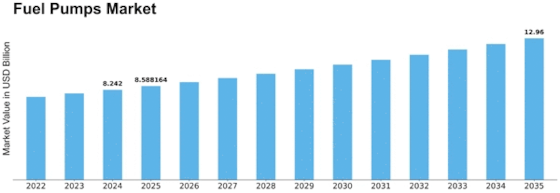

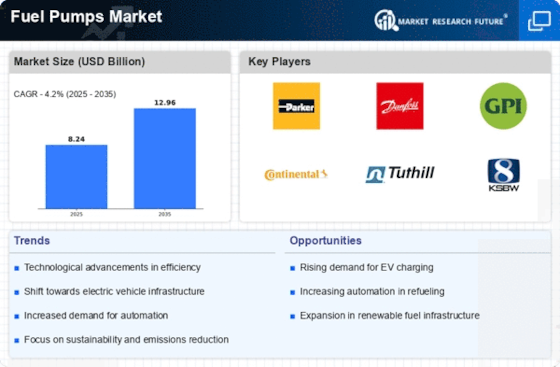

Fuel Pumps Market Growth Projections and Opportunities

The fuel pumps market is shaped by several aspects in the complex global economy. Fuel pump demand is intrinsically tied to automobile industry health. More automobiles on the road globally require efficient and dependable gasoline delivery systems. Fuel pump market dynamics are heavily impacted by vehicle production and sales patterns.

The advancement of automobile technology drives the fuel pumps markete. With the automobile industry shifting toward electric and hybrid vehicles, the fuel pump market is changing. Electric cars threaten the conventional fuel pumps marke, while hybrid vehicle demand has generated new opportunities. This technology transition affects gasoline pump type and market volume.

Crude oil price fluctuations also affect market dynamics. Oil and gas production costs affect fuel pump prices, hence the fuel pumps market is closely related to it. Any oil price variations might cascade on the fuel pumps marke, affecting production costs and customer demand. The fuel pumps industry has challenges due to oil price volatility caused by geopolitics, environmental laws, and production capacity of oil-producing nations.

Fuel pump market dynamics are also shaped by regulations. Automotive makers must build fuel-efficient automobiles as governments worldwide tighten pollution rules. This impacts gasoline pump design and specs. Demand for eco-friendly and energy-efficient gasoline pumps is also rising due to environmental concerns and carbon footprint awareness. Manufacturers must spend in R&D to satisfy changing regulatory criteria and market preferences.

The fuel pumps market's dynamics are complicated by their worldwide character. Economic factors, trade policies, and regional market patterns shape the landscape. Automotive sales rise in emerging nations with a growing middle class, driving fuel pump demand. However, established markets with significant vehicle saturation may see replacement and aftermarket sales when cars need maintenance and improvements.

Finally, global considerations affect fuel pump market dynamics. Stakeholders in the fuel pumps industry must traverse a complicated environment, from the progress of automobile technology to the impact of oil prices, regulatory standards, and economic conditions. Innovation, sustainability, and adaptability will determine success in this dynamic market as the business adapts.

Leave a Comment