North America : Health-Conscious Beverage Market

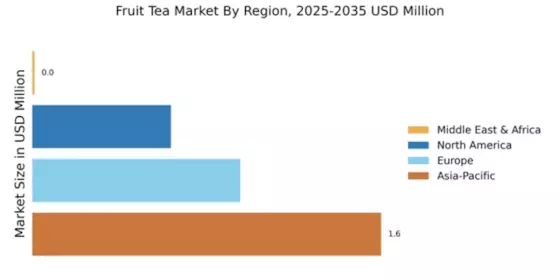

The North American fruit tea market is witnessing significant growth, driven by increasing health consciousness among consumers. With a market size of $0.62 billion, the demand for natural and organic beverages is on the rise. Regulatory support for health claims on packaging is also a catalyst for growth, encouraging brands to innovate and expand their offerings. The trend towards healthier lifestyles is pushing consumers to seek alternatives to sugary drinks, further boosting fruit tea sales. Leading the market are the United States and Canada, where major players like PepsiCo and Coca-Cola are investing in fruit tea products. The competitive landscape is characterized by a mix of established brands and emerging players, all vying for market share. The presence of key players such as Unilever and Harney & Sons enhances the market's dynamism, as they introduce new flavors and blends to cater to diverse consumer preferences.

Europe : Diverse Flavors and Preferences

Europe's fruit tea market, valued at $0.93 billion, is characterized by a diverse range of flavors and consumer preferences. The growth is fueled by increasing awareness of health benefits associated with fruit teas, alongside a shift towards natural ingredients. Regulatory frameworks in the EU promote transparency in labeling, which enhances consumer trust and drives demand. The market is also supported by a growing trend of tea consumption as a lifestyle choice, particularly among younger demographics. Germany, the UK, and France are leading countries in this market, with brands like Twinings and Dilmah gaining popularity. The competitive landscape is vibrant, with both local and international players competing for market share. The presence of established companies and innovative startups contributes to a dynamic environment, ensuring a steady influx of new products and flavors to meet evolving consumer tastes.

Asia-Pacific : Leading Global Market Share

The Asia-Pacific region is the largest market for fruit tea, with a market size of $1.56 billion. This growth is driven by rising disposable incomes, urbanization, and a growing preference for healthy beverages. The region's diverse climate allows for a wide variety of fruit tea flavors, appealing to local tastes. Regulatory support for health claims and organic certifications is also a significant driver, encouraging consumers to choose fruit teas over traditional sugary drinks. Countries like China, India, and Japan are at the forefront of this market, with key players such as Tata Global Beverages and Nestle leading the charge. The competitive landscape is marked by a mix of traditional tea brands and modern beverage companies, all striving to capture the growing health-conscious consumer base. The presence of both local and international brands ensures a rich variety of options for consumers, further fueling market growth.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region, with a market size of $0.01 billion, is in the early stages of fruit tea market development. The growth is primarily driven by increasing awareness of health benefits and a shift towards natural beverages. Regulatory initiatives aimed at promoting healthy lifestyles are beginning to take shape, which could catalyze market expansion in the coming years. The region's diverse cultures also contribute to a growing interest in unique fruit tea blends. Countries like South Africa and Kenya are emerging as key players in this market, with local brands starting to gain traction. The competitive landscape is still developing, with opportunities for both local and international brands to introduce innovative products. As consumer preferences evolve, the potential for growth in the fruit tea segment is significant, paving the way for future investments and market entry strategies.