Market Growth Projections

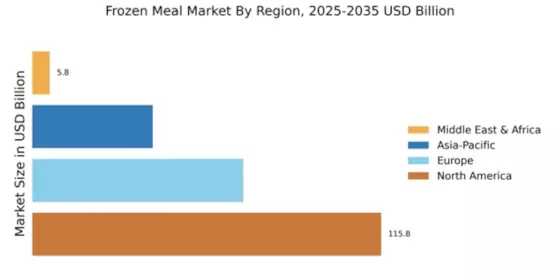

The Global Frozen Meal Market Industry is projected to experience substantial growth in the coming years. With an estimated market value of 219.7 USD Billion in 2024, the industry is expected to expand at a compound annual growth rate (CAGR) of 3.5% from 2025 to 2035. This growth trajectory indicates a robust demand for frozen meal products, driven by factors such as convenience, health trends, and technological advancements. As the market evolves, it is likely to attract new entrants and foster innovation, further enhancing its competitive landscape. The anticipated market value of 320.6 USD Billion by 2035 underscores the potential for continued expansion in this sector.

Health and Wellness Trends

The Global Frozen Meal Market Industry is witnessing a transformation as health-conscious consumers seek nutritious meal options. This shift is prompting manufacturers to innovate by incorporating organic ingredients, reducing sodium levels, and offering balanced meal solutions. The increasing awareness of dietary choices is reflected in the growing segment of frozen meals that cater to specific dietary needs, such as gluten-free or plant-based options. As the market evolves, it is anticipated that these health-oriented products will attract a broader consumer base, contributing to the industry's growth trajectory. This trend aligns with the projected market expansion, potentially reaching 320.6 USD Billion by 2035.

Expansion of Retail Channels

The Global Frozen Meal Market Industry benefits from the expansion of retail channels, including supermarkets, convenience stores, and online platforms. This diversification of distribution channels enhances accessibility for consumers, allowing them to purchase frozen meals with greater ease. The rise of e-commerce has particularly transformed the shopping experience, enabling consumers to order frozen meals from the comfort of their homes. As retailers increasingly stock a variety of frozen meal options, the market is poised for growth. This trend is expected to support the industry's expansion, aligning with the projected market value of 219.7 USD Billion in 2024.

Rising Demand for Convenience Foods

The Global Frozen Meal Market Industry experiences a notable surge in demand for convenience foods, driven by the fast-paced lifestyles of consumers. As individuals increasingly seek quick meal solutions, frozen meals provide an appealing option that requires minimal preparation time. In 2024, the market is projected to reach 219.7 USD Billion, reflecting a shift in consumer preferences towards ready-to-eat meals. This trend is particularly pronounced among working professionals and busy families, who prioritize convenience without sacrificing quality. The Global Frozen Meal Market Industry is thus positioned to capitalize on this growing demand, potentially enhancing its market share in the coming years.

Changing Demographics and Consumer Preferences

The Global Frozen Meal Market Industry is significantly influenced by changing demographics and evolving consumer preferences. Younger generations, particularly millennials and Gen Z, are more inclined to embrace frozen meals due to their convenience and variety. This demographic shift is accompanied by a growing interest in international cuisines, prompting manufacturers to diversify their offerings. As these consumers prioritize convenience and flavor, the market is likely to adapt by introducing innovative frozen meal options that cater to their tastes. This alignment with consumer preferences may contribute to the industry's growth, potentially reaching 320.6 USD Billion by 2035.

Technological Advancements in Food Preservation

Technological advancements in food preservation techniques significantly influence the Global Frozen Meal Market Industry. Innovations such as flash freezing and improved packaging methods enhance the quality and shelf life of frozen meals, ensuring that they retain their nutritional value and taste. These advancements not only improve consumer satisfaction but also reduce food waste, a growing concern in the food industry. As manufacturers adopt these technologies, they can offer a wider variety of frozen meal options that appeal to diverse consumer preferences. This evolution in food preservation is likely to bolster the industry's growth, contributing to a projected CAGR of 3.5% from 2025 to 2035.