North America : Market Leader in Logistics

North America is poised to maintain its leadership in the Frozen Food Logistic Market, holding a significant market share of 150.0. The region's growth is driven by increasing consumer demand for frozen foods, coupled with advancements in cold chain logistics technology. Regulatory support for food safety and transportation efficiency further catalyzes market expansion, ensuring that products remain fresh and compliant with health standards.

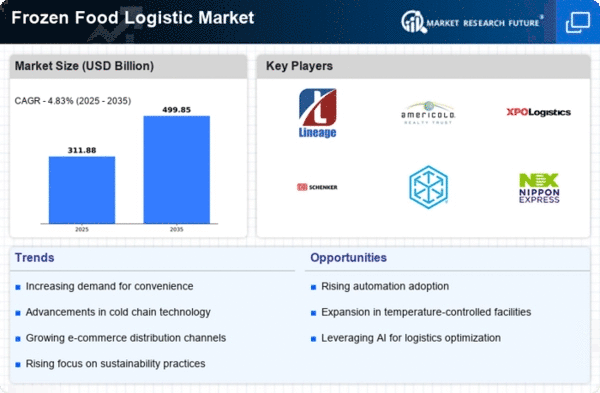

The competitive landscape is robust, featuring key players such as Lineage Logistics, Americold Realty Trust, and XPO Logistics. The U.S. stands out as the leading country, leveraging its extensive infrastructure and technological innovations. Companies are investing heavily in automation and sustainability practices to enhance operational efficiency and meet the rising demand for frozen food products.

Europe : Growing Market with Regulations

Europe's Frozen Food Logistic Market is experiencing significant growth, with a market size of 90.0. The region benefits from stringent food safety regulations and a rising trend towards convenience foods, driving demand for efficient logistics solutions. The European Union's commitment to sustainability and reducing food waste is also a key driver, encouraging investments in advanced cold chain technologies and practices.

Leading countries in this market include Germany, France, and the UK, where major players like Kuehne + Nagel and DB Schenker operate. The competitive landscape is characterized by a mix of established firms and emerging players, all striving to enhance their service offerings. The presence of strong regulatory frameworks ensures that logistics providers maintain high standards in food safety and quality.

Asia-Pacific : Emerging Market with Potential

The Asia-Pacific region, with a market size of 50.0, is emerging as a significant player in the Frozen Food Logistic Market. The growth is fueled by increasing urbanization, rising disposable incomes, and changing consumer preferences towards frozen food products. Additionally, government initiatives aimed at improving cold chain infrastructure are pivotal in enhancing logistics efficiency and food safety standards across the region.

Countries like Japan, China, and Australia are leading the charge, with key players such as Nippon Express and DHL Supply Chain making substantial investments. The competitive landscape is evolving, with both local and international firms vying for market share. As the region continues to develop its logistics capabilities, the demand for frozen food is expected to rise, presenting lucrative opportunities for stakeholders.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region, with a market size of 7.51, presents untapped opportunities in the Frozen Food Logistic Market. The growth is driven by increasing urbanization and a shift in consumer preferences towards frozen food products. However, challenges such as inadequate infrastructure and regulatory hurdles remain. Governments are beginning to recognize the importance of enhancing cold chain logistics to ensure food safety and quality, which is crucial for market growth.

Countries like South Africa and the UAE are at the forefront, with local and international players exploring the market. The competitive landscape is gradually evolving, with investments in logistics infrastructure and technology. As the region addresses its challenges, the potential for growth in frozen food logistics is significant, attracting interest from various stakeholders.