Aging Population

France's demographic landscape is shifting, with a growing proportion of the population aged 65 and older. This demographic change is likely to drive the vitamins minerals-supplement market, as older adults often require additional nutritional support to maintain their health. Data indicates that nearly 25% of the French population will be over 65 by 2030, creating a substantial market for supplements tailored to this age group. Products that support bone health, cognitive function, and cardiovascular health are particularly in demand. The vitamins minerals-supplement market is thus adapting to meet the needs of an aging population, potentially leading to increased innovation in product formulations.

E-commerce Growth

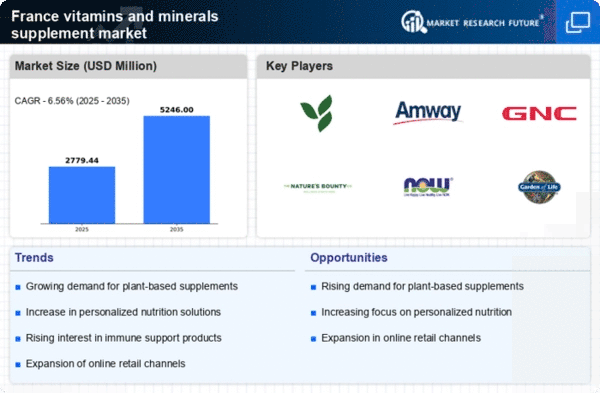

The rapid expansion of e-commerce in France is transforming the way consumers purchase vitamins and minerals. Online sales channels are becoming increasingly popular, with a reported growth rate of 15% in online supplement sales over the past year. This shift is likely to enhance accessibility and convenience for consumers, allowing them to explore a wider range of products. The vitamins minerals-supplement market is capitalizing on this trend by investing in digital marketing strategies and enhancing online shopping experiences. As more consumers turn to online platforms for their health needs, the market is expected to see continued growth driven by e-commerce.

Rising Health Consciousness

The increasing awareness of health and wellness among the French population appears to be a primary driver for the vitamins minerals-supplement market. Consumers are becoming more proactive about their health, leading to a surge in demand for dietary supplements. According to recent data, approximately 60% of adults in France regularly consume vitamins and minerals to enhance their overall well-being. This trend is likely to continue as individuals seek to prevent health issues and improve their quality of life. The vitamins minerals-supplement market is thus experiencing a notable shift towards products that promote immunity, energy, and overall vitality, reflecting a broader societal movement towards healthier lifestyles.

Increased Focus on Preventive Healthcare

The emphasis on preventive healthcare in France is influencing consumer behavior towards vitamins and minerals. Individuals are increasingly seeking ways to prevent health issues before they arise, which is driving demand for dietary supplements. Recent surveys indicate that over 70% of French consumers believe that taking vitamins can help prevent illnesses. This proactive approach to health is likely to bolster the vitamins minerals-supplement market, as consumers prioritize products that support long-term health and wellness. The market is thus witnessing a rise in formulations that cater to specific health concerns, reflecting this growing trend.

Influence of Social Media and Influencers

The role of social media and influencers in shaping consumer preferences cannot be overlooked in the vitamins minerals-supplement market. Platforms like Instagram and YouTube are increasingly being used to promote health and wellness products, with influencers often endorsing specific supplements. This trend appears to resonate particularly well with younger demographics, who are more likely to trust recommendations from social media figures. As a result, the vitamins minerals-supplement market is adapting its marketing strategies to leverage these platforms, potentially leading to increased brand awareness and consumer engagement. The impact of social media on purchasing decisions is likely to continue shaping the market landscape.