Rising Pet Ownership

The veterinary laboratory-testing market in France is experiencing growth due to the increasing number of pet owners. As more households adopt pets, the demand for veterinary services, including laboratory testing, rises. In 2025, it is estimated that approximately 50% of French households own a pet, leading to a heightened need for diagnostic services. This trend is further supported by the growing awareness of pet health and wellness, prompting owners to seek regular check-ups and preventive care. Consequently, veterinary laboratories are likely to see an uptick in testing services, as pet owners prioritize the health of their animals. This shift in consumer behavior is expected to drive revenue growth in the veterinary laboratory-testing market, as more tests are conducted to ensure the well-being of pets.

Growth of Pet Insurance

The expansion of pet insurance in France is contributing to the growth of the veterinary laboratory-testing market. As more pet owners opt for insurance coverage, they are more likely to seek veterinary care, including laboratory tests, without the burden of high out-of-pocket expenses. In 2025, it is estimated that around 30% of pets in France will be insured, leading to increased access to veterinary services. This trend encourages pet owners to pursue preventive care and diagnostic testing, as insurance coverage often includes these services. Consequently, the veterinary laboratory-testing market is poised for growth, as the financial support provided by pet insurance enables owners to prioritize their pets' health and well-being.

Increased Awareness of Animal Health

There is a growing awareness of animal health among pet owners in France, which is positively influencing the veterinary laboratory-testing market. As consumers become more informed about the importance of regular health screenings and preventive care, the demand for laboratory tests is expected to rise. This trend is reflected in the increasing expenditure on pet healthcare, which has seen a steady increase of around 8% annually. Pet owners are now more inclined to invest in diagnostic tests to detect potential health issues early, thereby improving the quality of life for their pets. This heightened awareness is likely to result in a more robust veterinary laboratory-testing market, as veterinarians respond to the demand for comprehensive testing services to meet the needs of health-conscious pet owners.

Advancements in Diagnostic Technologies

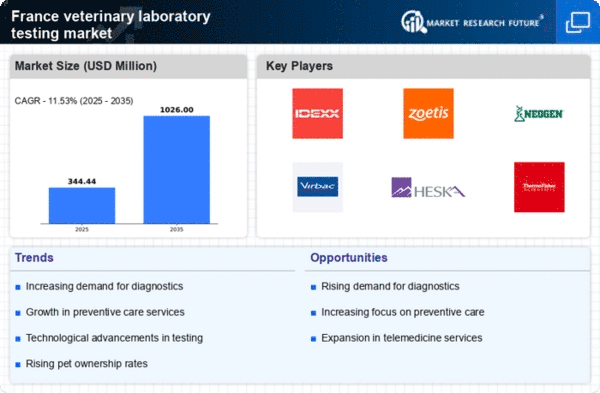

Technological innovations are significantly impacting the veterinary laboratory-testing market in France. The introduction of advanced diagnostic tools, such as PCR and ELISA tests, enhances the accuracy and speed of disease detection in animals. These technologies allow veterinarians to provide timely and effective treatment, which is crucial for pet health. In 2025, the market for veterinary diagnostics in France is projected to reach €500 million, reflecting a compound annual growth rate (CAGR) of 6% over the next five years. The integration of digital platforms for test results and telemedicine services further streamlines the process, making it easier for veterinarians to access and interpret data. As these technologies become more prevalent, they are likely to drive the growth of the veterinary laboratory-testing market, as practitioners increasingly rely on sophisticated testing methods to diagnose and treat animal health issues.

Regulatory Compliance and Quality Standards

The veterinary laboratory-testing market in France is influenced by stringent regulatory compliance and quality standards. Regulatory bodies enforce guidelines that ensure the accuracy and reliability of laboratory tests, which is crucial for maintaining public trust in veterinary services. In 2025, compliance with these regulations is expected to drive investments in laboratory infrastructure and technology, as veterinary practices strive to meet the required standards. This focus on quality not only enhances the credibility of veterinary laboratories but also encourages pet owners to utilize testing services. As a result, the veterinary laboratory-testing market is likely to benefit from increased demand for high-quality diagnostic services, as veterinarians prioritize compliance with regulations to ensure the best outcomes for animal health.