Growing Geriatric Population

The demographic shift towards an older population in France is a significant driver for the ventricular assist-devices market. As individuals age, the risk of developing heart-related conditions increases, leading to a higher demand for advanced cardiac support solutions. By 2030, it is estimated that over 20% of the French population will be aged 65 and older, creating a substantial market for ventricular assist devices. This trend necessitates the development of tailored solutions that cater to the unique needs of elderly patients, thereby fostering innovation and growth within the market. Healthcare providers are likely to focus on integrating these devices into standard care protocols for older adults.

Innovations in Device Technology

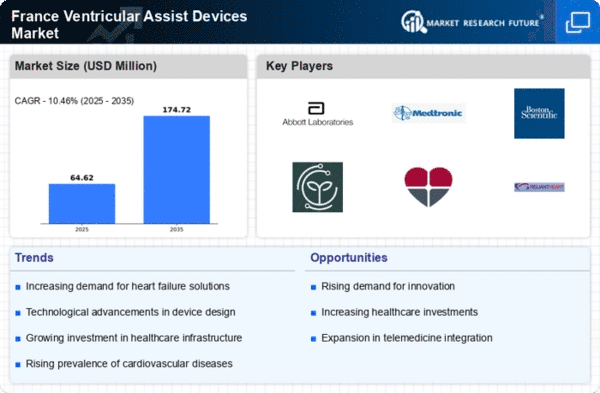

Technological advancements in the design and functionality of ventricular assist devices are significantly influencing the market. Recent innovations have led to the development of smaller, more efficient devices that offer improved patient comfort and outcomes. For instance, the introduction of continuous-flow devices has shown to enhance the quality of life for patients with severe heart failure. In France, the market is projected to grow at a CAGR of around 8% over the next few years, driven by these innovations. Furthermore, the integration of remote monitoring technologies allows for better management of patients, which is likely to increase the adoption of these devices in clinical settings.

Rising Incidence of Heart Failure

The increasing prevalence of heart failure in France is a primary driver for the ventricular assist-devices market. According to recent health statistics, approximately 1.5 million individuals in France are affected by heart failure, leading to a growing demand for advanced treatment options. This condition often necessitates the use of ventricular assist devices as a bridge to heart transplantation or as a long-term solution for patients who are not candidates for surgery. The aging population, coupled with lifestyle factors such as obesity and diabetes, contributes to this rising incidence. Consequently, healthcare providers are increasingly adopting ventricular assist devices to improve patient outcomes, thereby propelling the market forward.

Government Initiatives and Funding

Government initiatives aimed at improving cardiovascular health are playing a crucial role in the ventricular assist-devices market. In France, the government has allocated substantial funding for research and development in the field of cardiac care. This financial support is directed towards enhancing the accessibility and affordability of ventricular assist devices for patients. Additionally, public health campaigns focused on heart health are raising awareness about the benefits of these devices. As a result, the market is expected to experience growth as more patients gain access to life-saving technologies, supported by favorable policies and funding from health authorities.

Increased Collaboration Between Stakeholders

The ventricular assist-devices market is witnessing enhanced collaboration among various stakeholders, including manufacturers, healthcare providers, and research institutions. This collaborative approach is fostering innovation and accelerating the development of new devices. In France, partnerships between academic institutions and industry players are leading to breakthroughs in device technology and patient care strategies. Such collaborations are essential for addressing the complex challenges associated with heart failure treatment. As stakeholders work together to share knowledge and resources, the market is expected to benefit from improved product offerings and enhanced patient outcomes, ultimately driving growth in the ventricular assist-devices market.