Increased Healthcare Expenditure

The rising healthcare expenditure in France is a crucial factor propelling the urinary catheters market. With the French government investing heavily in healthcare infrastructure and services, there is a growing emphasis on improving patient care and outcomes. In 2025, healthcare spending is anticipated to account for approximately 12% of the national GDP, reflecting a commitment to enhancing medical services. This increase in funding allows hospitals and clinics to procure advanced urinary catheter products, thereby expanding their treatment options for patients. The urinary catheters market stands to gain from this trend, as healthcare facilities are more likely to adopt innovative catheter solutions that align with their quality improvement initiatives.

Advancements in Catheter Technology

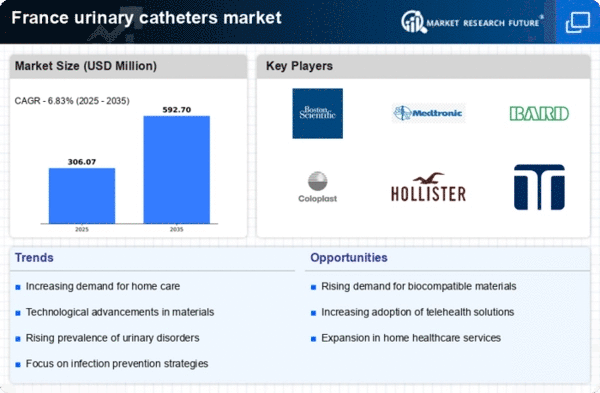

Technological innovations in catheter design and materials are significantly influencing the urinary catheters market. Recent developments include the introduction of hydrophilic-coated catheters, which reduce friction and enhance patient comfort. Additionally, antimicrobial coatings are being integrated to minimize the risk of urinary tract infections, a common complication associated with catheter use. The market is witnessing a shift towards more user-friendly products, such as pre-lubricated catheters that facilitate self-catheterization. These advancements not only improve patient outcomes but also align with healthcare providers' goals of enhancing care quality. As a result, the urinary catheters market is expected to experience robust growth, with an estimated increase in market value projected to reach €500 million by 2027.

Rising Incidence of Urinary Disorders

The increasing prevalence of urinary disorders in France is a primary driver for the urinary catheters market. Conditions such as urinary incontinence, benign prostatic hyperplasia, and urinary tract infections are becoming more common, particularly among the aging population. According to recent health statistics, approximately 30% of individuals over 65 experience some form of urinary incontinence. This demographic shift is likely to escalate the demand for urinary catheters, as healthcare providers seek effective solutions to manage these conditions. The urinary catheters market is thus positioned to benefit from this growing need, as hospitals and clinics expand their offerings to accommodate patients requiring catheterization. Furthermore, the rising awareness of urinary health issues is prompting more individuals to seek medical advice, further driving market growth.

Growing Awareness of Patient-Centric Care

The shift towards patient-centric care in France is reshaping the urinary catheters market. Healthcare providers are increasingly focusing on the needs and preferences of patients, leading to a demand for more personalized catheter solutions. This trend is evident in the development of catheters that cater to specific patient demographics, such as pediatric or geriatric populations. Additionally, educational campaigns aimed at raising awareness about urinary health are encouraging patients to engage in discussions with their healthcare providers regarding catheter options. As a result, the urinary catheters market is likely to see a rise in demand for products that prioritize patient comfort and usability, ultimately enhancing the overall patient experience.

Regulatory Support for Innovative Products

Regulatory frameworks in France are evolving to support the introduction of innovative urinary catheter products. The French health authorities are actively promoting the adoption of advanced medical devices that demonstrate improved safety and efficacy. This regulatory environment encourages manufacturers to invest in research and development, leading to the creation of next-generation catheters that address existing challenges in catheterization. The urinary catheters market is thus poised for growth, as new products that meet regulatory standards are introduced to the market. Furthermore, the streamlined approval processes for innovative devices may accelerate the availability of these products, benefiting both healthcare providers and patients.