Government Initiatives and Funding

Government initiatives play a pivotal role in shaping the smart healthcare market in France. The French government has allocated substantial funding to promote digital health solutions, aiming to enhance healthcare accessibility and quality. In 2025, the government announced a €500 million investment to support the development of smart healthcare technologies. This funding is directed towards research and development, fostering innovation in telemedicine and health informatics. Additionally, regulatory frameworks are being established to facilitate the adoption of these technologies. Such proactive measures by the government are likely to stimulate growth in the smart healthcare market, encouraging private sector participation and investment.

Integration of Health Data Systems

The integration of health data systems is emerging as a crucial driver for the smart healthcare market in France. The ability to consolidate patient data from various sources enhances the quality of care and facilitates informed decision-making. In 2025, approximately 70% of healthcare providers in France are expected to adopt integrated health information systems. This integration allows for seamless communication between healthcare professionals, improving care coordination and patient outcomes. Moreover, the use of big data analytics in healthcare is anticipated to grow, providing insights that can lead to more effective treatment strategies. Such advancements are likely to propel the smart healthcare market, as stakeholders recognize the value of integrated data systems.

Aging Population and Chronic Diseases

The demographic shift towards an aging population in France is significantly impacting the smart healthcare market. As the population ages, the prevalence of chronic diseases such as diabetes and cardiovascular conditions increases. This trend necessitates the adoption of smart healthcare solutions that can provide continuous monitoring and management of these conditions. It is estimated that by 2030, over 25% of the French population will be over 65 years old, creating a substantial demand for innovative healthcare services. Smart healthcare technologies, including remote monitoring and telehealth services, are essential in addressing the needs of this demographic, thereby driving market growth.

Technological Advancements in Healthcare

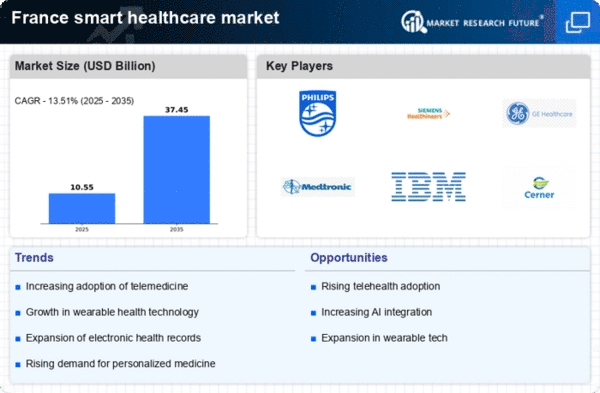

The smart healthcare market in France is experiencing a surge due to rapid technological advancements. Innovations in artificial intelligence, machine learning, and the Internet of Things (IoT) are transforming healthcare delivery. For instance, AI-driven diagnostic tools are enhancing accuracy and efficiency in patient care. The market is projected to grow at a CAGR of 25% from 2025 to 2030, indicating a robust demand for smart healthcare solutions. Furthermore, the integration of IoT devices allows for real-time monitoring of patients, which is crucial for chronic disease management. This technological evolution not only improves patient outcomes but also streamlines operational efficiencies within healthcare facilities, thereby driving the smart healthcare market forward.

Consumer Demand for Personalized Healthcare

There is a growing consumer demand for personalized healthcare solutions in France, which is influencing the smart healthcare market. Patients are increasingly seeking tailored health services that cater to their individual needs and preferences. This shift is prompting healthcare providers to adopt smart technologies that enable personalized treatment plans and real-time health monitoring. The market for personalized medicine is expected to reach €10 billion by 2027, reflecting a significant opportunity for growth. As consumers become more health-conscious and tech-savvy, the integration of smart healthcare solutions that offer personalized experiences is likely to become a key driver in the market.