Impact of Lifestyle Changes on Health

Lifestyle changes among the French population are increasingly recognized as a driver of the overactive bladder-treatment market. Factors such as obesity, sedentary behavior, and dietary habits have been linked to the exacerbation of OAB symptoms. With approximately 30% of the adult population classified as overweight or obese, there is a growing awareness of the need for lifestyle modifications to manage OAB effectively. Health campaigns promoting physical activity and balanced diets are likely to encourage individuals to seek treatment for OAB symptoms. Additionally, healthcare professionals are emphasizing the importance of lifestyle interventions as part of comprehensive treatment plans. This focus on lifestyle changes not only aids in symptom management but also contributes to the overall growth of the overactive bladder-treatment market, as more patients engage with healthcare services.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research are significantly impacting the overactive bladder-treatment market. Recent advancements have led to the development of novel medications that offer improved efficacy and reduced side effects compared to traditional treatments. For instance, the introduction of antimuscarinic agents and beta-3 adrenergic agonists has provided patients with more options for managing their symptoms. The French pharmaceutical industry is actively investing in research and development, with expenditures reaching approximately €3 billion annually. This investment is likely to yield new therapeutic agents that could enhance patient outcomes and adherence to treatment regimens. As a result, the continuous evolution of pharmaceutical research is expected to drive growth in the overactive bladder-treatment market, catering to the diverse needs of patients across France.

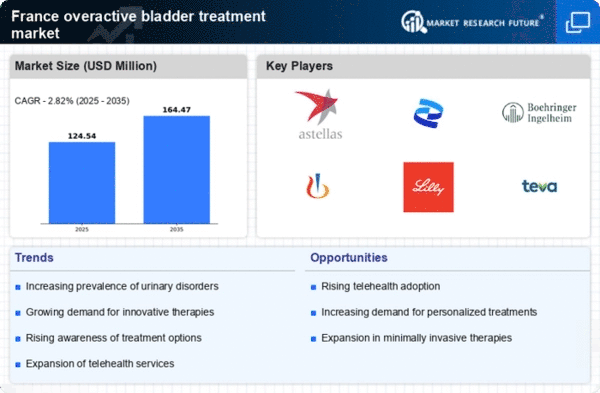

Increasing Prevalence of Overactive Bladder

The rising incidence of overactive bladder (OAB) in France is a crucial driver for the overactive bladder-treatment market. Recent studies indicate that approximately 16% of the adult population in France experiences symptoms of OAB, which translates to millions of individuals seeking effective treatment options. This growing prevalence is likely to increase demand for various therapeutic interventions, including medications and behavioral therapies. As awareness of OAB symptoms expands, more patients are likely to consult healthcare professionals, thereby propelling market growth. Furthermore, the aging population in France, with a significant proportion over 65 years, is particularly susceptible to OAB, further amplifying the need for targeted treatments. Consequently, the increasing prevalence of OAB is a pivotal factor influencing the dynamics of the overactive bladder-treatment market.

Government Initiatives and Healthcare Policies

Government initiatives and healthcare policies play a vital role in shaping the overactive bladder-treatment market. In France, the government has implemented various health programs aimed at improving access to healthcare services for individuals suffering from chronic conditions, including OAB. These initiatives often include subsidized treatments and increased funding for research into urological disorders. For instance, the French Ministry of Health has allocated significant resources to enhance awareness campaigns and support healthcare providers in diagnosing and treating OAB. Such policies not only facilitate better access to treatment but also encourage patients to seek help, thereby expanding the market. The proactive stance of the government in addressing OAB is likely to foster a more favorable environment for the overactive bladder-treatment market.

Growing Demand for Non-Invasive Treatment Options

The increasing preference for non-invasive treatment options is a notable driver in the overactive bladder-treatment market. Patients in France are increasingly seeking alternatives to surgical interventions, favoring therapies that minimize recovery time and associated risks. Non-invasive treatments, such as neuromodulation and behavioral therapies, are gaining traction due to their effectiveness and lower complication rates. Market data suggests that non-invasive therapies are projected to account for a growing share of the overall treatment landscape, with an estimated growth rate of 8% annually. This shift in patient preference is likely to influence healthcare providers to expand their offerings, thereby enhancing the overall market for overactive bladder treatments. As patients become more informed about their options, the demand for non-invasive solutions is expected to rise.