Increasing Data Traffic

There is a surge in data traffic, driven by the proliferation of digital services and applications. As businesses and consumers increasingly rely on high-bandwidth applications such as video streaming, cloud computing, and IoT devices, the demand for robust optical network solutions intensifies. Reports indicate that data traffic in France is projected to grow at a compound annual growth rate (CAGR) of approximately 25% over the next five years. This escalating demand necessitates the deployment of advanced optical network-hardware to ensure seamless connectivity and efficient data transmission. Consequently, manufacturers are focusing on developing innovative solutions that can handle this increased load, thereby propelling growth in the optical network-hardware market.

Focus on Sustainable Solutions

Sustainability is becoming a critical driver in the optical network-hardware market as companies and governments in France prioritize eco-friendly practices. The optical network-hardware market is witnessing a shift towards energy-efficient solutions that reduce carbon footprints and operational costs. Manufacturers are increasingly investing in research and development to create products that not only meet performance standards but also adhere to environmental regulations. The French government has set ambitious targets for reducing greenhouse gas emissions, which may lead to increased demand for sustainable optical technologies. This focus on sustainability could potentially reshape the competitive landscape, as companies that prioritize eco-friendly innovations may gain a competitive edge in the optical network-hardware market.

Growing Cybersecurity Concerns

As the digital landscape evolves, cybersecurity has emerged as a paramount concern for organizations in France, impacting the optical network-hardware market. The increasing frequency of cyber threats necessitates the implementation of secure communication channels, prompting businesses to invest in advanced optical solutions that offer enhanced security features. The market is likely to see a rise in demand for optical network-hardware that incorporates robust encryption and security protocols. Market Research Future indicate that the cybersecurity market in France is expected to grow by approximately 20% annually, which may drive parallel growth in the optical network-hardware market as organizations seek to fortify their networks against potential breaches. This heightened focus on security could lead to innovative developments in optical technologies.

Rising Adoption of 5G Technology

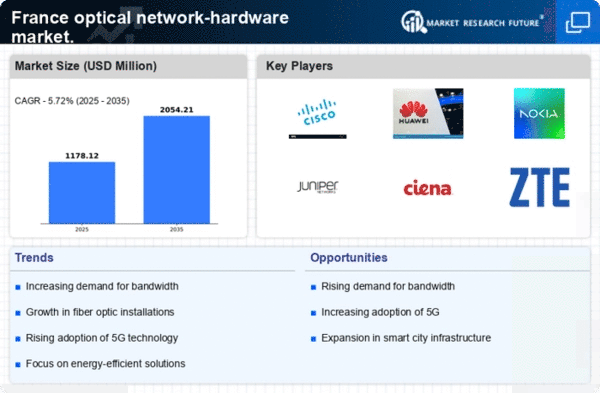

The rollout of 5G technology in France is poised to have a profound impact on the optical network-hardware market. As telecommunications providers expand their 5G networks, there is a growing need for high-capacity optical infrastructure to support the increased data rates and lower latency that 5G promises. Industry analysts suggest that the demand for optical network-hardware will rise sharply, with projections indicating a market growth of over 30% in the next few years. This shift towards 5G necessitates the upgrading of existing optical networks, creating opportunities for manufacturers to innovate and provide solutions that meet the stringent requirements of next-generation mobile networks. The convergence of 5G and optical technologies is likely to redefine connectivity in France.

Investment in Smart City Infrastructure

France's commitment to developing smart city initiatives is significantly influencing the optical network-hardware market. As urban areas evolve, the need for advanced communication networks becomes paramount. Smart city projects require reliable and high-speed connectivity to support various applications, including traffic management, public safety, and environmental monitoring. The French government has allocated substantial funding for these initiatives, with investments expected to reach €1 billion by 2027. This financial backing is likely to stimulate demand for optical network-hardware, as municipalities seek to implement cutting-edge technologies that enhance urban living. The integration of optical solutions into smart city frameworks is anticipated to create new opportunities for market players.