Cultural Heritage and Prestige

The France Luxury Wines Spirits Market is deeply intertwined with the country's rich cultural heritage and historical significance in winemaking. French wines are often associated with luxury, sophistication, and tradition, which appeals to consumers seeking premium experiences. The global perception of French wines as a symbol of status contributes to their desirability, particularly among affluent consumers. This cultural prestige is further enhanced by events such as wine festivals and tastings, which showcase the diversity and craftsmanship of French wines. As the market continues to evolve, the emphasis on heritage and quality is likely to remain a key driver, attracting consumers who value authenticity and tradition in their purchasing decisions.

Innovative Marketing Strategies

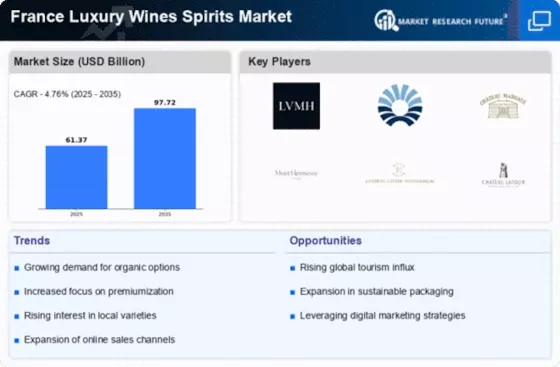

The France Luxury Wines Spirits Market is witnessing a shift towards innovative marketing strategies that leverage digital platforms and social media to engage consumers. Producers are increasingly utilizing storytelling and experiential marketing to create emotional connections with their audience. This approach not only enhances brand visibility but also fosters loyalty among consumers. Recent data suggests that brands employing digital marketing strategies have seen a 20% increase in customer engagement. As the market becomes more competitive, the adoption of these innovative marketing techniques is likely to play a pivotal role in driving growth within the France Luxury Wines Spirits Market, enabling brands to reach a broader audience and enhance their market presence.

Growing Global Demand for French Wines

The France Luxury Wines Spirits Market is experiencing a notable increase in global demand for French wines, particularly in emerging markets such as Asia and North America. This trend is driven by the rising affluence of consumers in these regions, who are increasingly seeking premium products. According to recent data, exports of French wines have surged, with a reported increase of 15% in value over the past year. This growing appreciation for French wines is not only enhancing the market's prestige but also encouraging producers to innovate and maintain high-quality standards. As a result, the France Luxury Wines Spirits Market is likely to benefit from this expanding consumer base, which is eager to explore the rich heritage and diverse offerings of French wines.

Regulatory Support for Quality Standards

The France Luxury Wines Spirits Market is bolstered by stringent regulatory frameworks that ensure the quality and authenticity of French wines and spirits. The Appellation d'Origine Contrôlée (AOC) system plays a crucial role in maintaining high standards, which enhances consumer trust and brand loyalty. This regulatory support not only protects the reputation of French products but also promotes sustainable practices among producers. Recent statistics indicate that AOC wines account for approximately 50% of total wine production in France, underscoring the importance of these regulations. As consumers become more discerning, the emphasis on quality and authenticity is likely to drive growth in the France Luxury Wines Spirits Market, attracting both domestic and international buyers.

Sustainability and Eco-Friendly Practices

The France Luxury Wines Spirits Market is increasingly influenced by the growing consumer preference for sustainability and eco-friendly practices. Producers are adopting organic and biodynamic farming methods, which not only appeal to environmentally conscious consumers but also enhance the quality of the products. Recent surveys indicate that approximately 30% of consumers are willing to pay a premium for sustainably produced wines. This shift towards sustainability is likely to drive innovation within the industry, as producers seek to meet the evolving demands of consumers. As the France Luxury Wines Spirits Market embraces these practices, it may enhance its reputation and attract a new segment of environmentally aware consumers, further contributing to market growth.