Regulatory Compliance and Safety Standards

The laboratory furniture market is significantly influenced by stringent regulatory compliance and safety standards mandated by French authorities. Laboratories are required to adhere to specific guidelines that ensure the safety and functionality of their environments. This includes the use of furniture that meets fire safety regulations, chemical resistance, and ergonomic design principles. As a result, manufacturers are compelled to innovate and produce furniture that not only complies with these regulations but also enhances user safety and comfort. The increasing focus on workplace safety is expected to drive growth in the laboratory furniture market, as institutions prioritize investments in compliant and high-quality furniture.

Increased Focus on Ergonomics and User Comfort

the laboratory furniture market is experiencing a shift towards ergonomic designs that prioritize user comfort and productivity.. As research activities become more demanding, the need for furniture that supports long hours of work without causing strain is becoming increasingly apparent. Manufacturers are responding to this trend by developing adjustable workstations, anti-fatigue mats, and supportive seating options. This focus on ergonomics is not only beneficial for researchers but also aligns with the growing awareness of workplace wellness. Consequently, the laboratory furniture market is likely to see a rise in demand for ergonomic solutions that enhance user experience and efficiency.

Rising Demand for Advanced Research Facilities

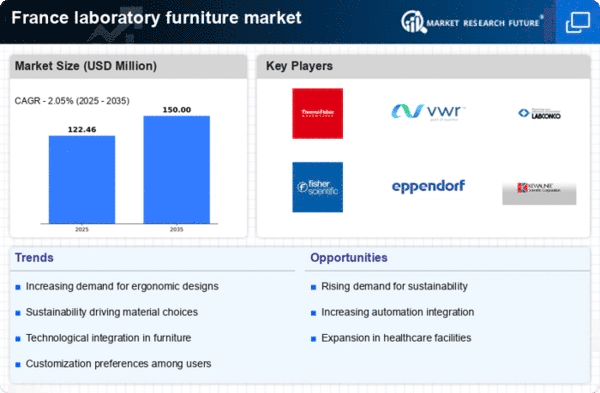

The laboratory furniture market in France is experiencing a notable surge in demand due to the increasing establishment of advanced research facilities. This trend is driven by the growing emphasis on scientific research and innovation across various sectors, including pharmaceuticals, biotechnology, and environmental science. As of 2025, the investment in research and development (R&D) in France is projected to reach approximately €60 billion, indicating a robust commitment to enhancing laboratory capabilities. Consequently, this influx of funding is likely to stimulate the laboratory furniture market, as institutions seek to equip their facilities with modern, efficient, and ergonomic furniture solutions that support complex research activities.

Technological Advancements in Laboratory Equipment

Technological advancements in laboratory equipment are driving changes in the laboratory furniture market. As laboratories adopt more sophisticated instruments and technologies, the need for compatible furniture that accommodates these innovations becomes critical. For instance, the integration of digital tools and automated systems necessitates furniture that can support various configurations and layouts. This trend is particularly relevant in sectors such as pharmaceuticals and biotechnology, where precision and efficiency are paramount. As a result, the laboratory furniture market is expected to evolve, with manufacturers focusing on creating adaptable and technologically compatible furniture solutions that meet the demands of modern laboratories.

Growth of Educational Institutions and Training Centers

The expansion of educational institutions and training centers in France is a key driver for the laboratory furniture market. With an increasing number of universities and vocational schools emphasizing practical training in scientific disciplines, the demand for specialized laboratory furniture is on the rise. As of 2025, it is estimated that the number of higher education institutions in France will exceed 3,500, leading to a heightened need for well-equipped laboratories. This growth presents opportunities for manufacturers to supply tailored furniture solutions that cater to the specific needs of educational environments, thereby contributing to the overall expansion of the laboratory furniture market.