Regulatory Changes and Compliance

The investment banking market in France is currently influenced by evolving regulatory frameworks that demand strict compliance from financial institutions. The implementation of the European Union's MiFID II directive has necessitated significant adjustments in trading practices and transparency requirements. This has led to increased operational costs for investment banks, as they must invest in compliance technologies and training. Furthermore, the French Financial Markets Authority (AMF) continues to enhance its oversight, which may impact the competitive landscape. As a result, investment banks are compelled to adapt their strategies to ensure compliance while maintaining profitability. The ongoing regulatory scrutiny could potentially reshape the investment banking market, as firms that fail to comply may face substantial penalties, thereby affecting their market position.

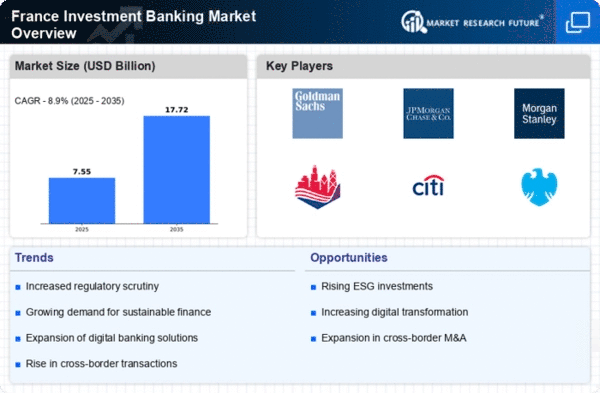

Increased Focus on ESG Investments

The investment banking market in France is experiencing a notable shift towards Environmental, Social, and Governance (ESG) investments, driven by growing awareness among investors and regulatory pressures. French financial institutions are increasingly integrating ESG criteria into their investment strategies, reflecting a broader trend towards sustainable finance. This shift is evidenced by the rise in green bonds and sustainable investment products, which have gained traction among institutional investors. As a result, investment banks are adapting their advisory services to cater to this demand, offering specialized products that align with ESG principles. The emphasis on sustainability is likely to reshape the investment banking market, as firms that prioritize ESG considerations may attract a more diverse client base and enhance their reputational standing.

Economic Growth and Market Sentiment

The investment banking market in France appears to be buoyed by positive economic growth indicators, which foster a favorable environment for mergers and acquisitions (M&A) activities. Recent data suggests that France's GDP growth rate is projected to reach 2.5% in 2025, stimulating corporate investments and capital market activities. This economic expansion is likely to enhance investor confidence, leading to increased demand for advisory services in the investment banking sector. Additionally, as companies seek to capitalize on growth opportunities, the volume of equity and debt issuances may rise, further benefiting investment banks. The interplay between economic growth and market sentiment is crucial, as it directly influences the volume of transactions and the overall health of the investment banking market.

Global Market Dynamics and Competition

The investment banking market in France is influenced by global market dynamics, which can create both opportunities and challenges for local firms. The increasing competition from international investment banks entering the French market may intensify pressure on domestic players to innovate and differentiate their services. Additionally, fluctuations in global financial markets can impact capital flows and investment strategies, affecting the overall performance of the investment banking sector. As firms navigate these complexities, they may need to adopt more agile business models to respond to changing market conditions. The interplay between local and global factors is crucial, as it shapes the competitive landscape and influences the strategic decisions made by investment banks operating in France.

Technological Advancements in Financial Services

Technological advancements are reshaping the investment banking market in France, as firms increasingly adopt digital solutions to enhance efficiency and client engagement. The rise of fintech companies has introduced innovative platforms that streamline processes such as trading, risk management, and client onboarding. Investment banks are now leveraging artificial intelligence and big data analytics to gain insights into market trends and client preferences. This technological integration not only improves operational efficiency but also enhances the client experience, which is vital in a competitive landscape. As investment banks continue to invest in technology, the market is likely to witness a transformation in service delivery, potentially leading to increased market share for those who effectively harness these advancements.