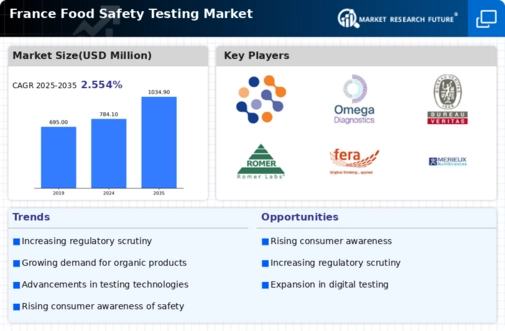

The France Food Safety Testing Market is currently undergoing changes as a result of greater consumer awareness of food safety and health issues. This shift is primarily driven by rampant cases of foodborne illnesses and contamination that has heightened public awareness about what they consume. The French government, through its Ministry of Agriculture and Food, actively promotes and enforces food safety regulations which pushes companies to adopt more rigorous testing procedures.

This focus on safety, which enables compliance with regulations, motivates food manufacturers and retailers to invest in advanced safety testing measures and technologies to not only meet regulatory requirements, but to also maintain a competitive edge in the market.

In addition, the trend toward organic as well as locally grown foods is also increasing in France. There is a growing demand for food products that go beyond safety standards but are also environmentally friendly. This change makes it possible for food testing laboratories to take up new challenges in the analysis of organic products, thereby improving their service and fostering growth in the market. There is also a growing popularity in the demand for rapid testing systems as industries strive to keep their processes running smoothly.

Technologies such as real-time testing solutions and biosensors are being used more widely to uphold the safety and quality standards of food.

Lately, France has concentrated on automating the testing of food safety. The use of information technologies for the monitoring and analysis of supply chains is fast changing, yielding more efficient testing processes and improved product traceability. As a France Food safety testing Market exampl at the France market adopted these technologies, it led to more reliable, quicker, and cheaper food safety testing. Hence, the France food safety testing is undergoing a paradigm shift influenced by regulations, the proactive stance of consumers, and innovation in technologies.

France food safety testing is a critical component of the country’s agri-food ecosystem, guided by strict food control regulations France that align with both national standards and broader European Union requirements to protect public health. To meet these regulatory expectations, businesses increasingly rely on professional food safety services Paris, which support manufacturers, exporters, and foodservice operators with testing, audits, and compliance guidance. The presence of advanced French food testing labs enables accurate microbiological, chemical, and allergen analysis, helping companies demonstrate full food safety compliance France while maintaining product quality and traceability. Together, these elements highlight France’s strong regulatory framework and the growing importance of comprehensive food safety testing and compliance services within the French food and beverage industry.